SPRX

Winter 2023

Active

AI for corporate R&D tax credits

SPRX uses AI to prepare corporate R&D tax credits.

With our technology, anyone can prepare an R&D Tax Credit accurately and fast. To provide some background, the R&D Credit is often cited as the most complex and audited tax credit in the United States. With that in mind, we set out to create software to achieve two primary objectives:

1. Ensure that any credit computed with our software is exactly what the IRS is asking for in terms of quality.

2. Democratize the ability to perform high quality R&D Credit studies extremely fast.

Active Founders

Latest News

Oct 11, 2024

Company Launches

💸 SPRX Technologies – Making R&D Credits simple, fast, and affordable.

See original launch postTL;DR

SPRX is TurboTax for the R&D Tax Credit. With our technology, R&D Credits are simple, fast, and affordable.

Want to see a demo? Schedule a call with us here!

❌ The problem

The R&D Credit is often cited as the most complex and audited tax credit in the United States.

When companies do decide to claim an R&D Credit, they often face analysis costs that can be greater than the credit itself!

🧠 SPRX Solution

SPRX automates the analysis. When using our software credits computed are:

- Exactly what the government is asking for

- Completed up to 80% faster than other providers

- Cost, on average, 50% less

⚙️ How does SPRX work?

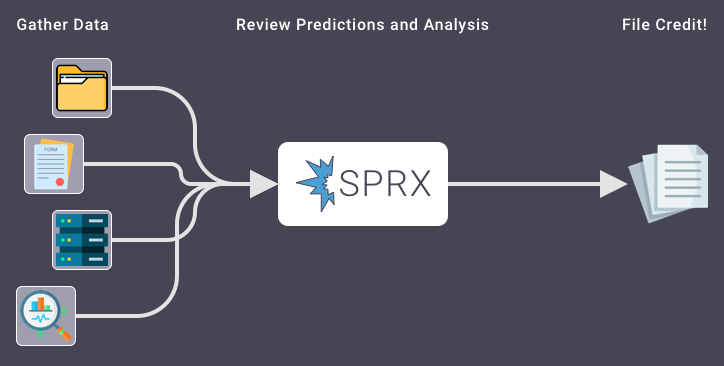

SPRX uses technology to break the R&D Credit analysis into three easy steps:

- Gather Data

- Review Predictions and Analysis

- File Your Credit!

🤝 Ask!

If you want to learn more about how SPRX can make your R&D Credit process simple, fast, and affordable you can:

Jobs at SPRX

New York, NY, US

$70K - $80K

Any (new grads ok)

New York, NY, US / Remote (Los Angeles, CA, US; CA, US; Houston, TX, US)

$110K - $130K

3+ years

Los Angeles, CA, US / CA, US / Remote (Los Angeles, CA, US; CA, US)

$90K - $110K

1+ years