Convoy: The Future of Truck Freight

by Anu Hariharan1/21/2021

Online marketplaces bring efficiency to traditional sectors. They offer a better user experience and increase margins for participants. They can accrue huge value by reducing friction and aggregating supply and demand — particularly because they have the ability to build network effects and economies of scale. We have seen this play out across several business-to-consumer verticals over the past decade: Airbnb in hospitality, Instacart in grocery, DoorDash in food delivery, and Lyft in transportation.

Truck freight is one of the largest industries in the US. Domestic shippers like Unilever spend nearly $800 billion annually transporting raw materials and consumer goods by truck1. Truck freight is also one of the least efficient industries: It’s chaotic, highly fragmented, regional, and, plainly, a logistical nightmare. Shippers, trucking companies (“carriers”), and drivers rely on high-priced brokers who coordinate shipments over phone calls and email. Valuable time and money is lost in the process. There is a clear opportunity to upend the status quo, but its intricacies have made freight one of the toughest sectors in which to build an online marketplace. In the last few years, incumbents have started to adopt technology to fix inefficiencies, but they’ve focused on tools to streamline individual tasks (e.g., dashboards to help price freight when brokers are calling around to find a truck), rather than rethinking the process of booking freight entirely.

When we first started working with Convoy in 2017, the company had fewer than five large shippers on its platform, served less than half of the United States, and relied on manual operations for more than 30% of shipments. But we backed Convoy at this early growth stage because we saw its potential to bring the truck freight industry online and transform its utility. Truck freight is uniquely challenging, and we believe Convoy is poised to change the economy of the entire industry.

Convoy and the Truck Freight Industry

In building an online freight marketplace, Convoy has had to solve four key industry frictions: (1) a highly fragmented market, (2) complex supply and demand matching requirements, (3) an industry-wide driver shortage, and (4) opaque and highly volatile truck-prices and capacity. Each of these problems drives up costs and time spent for both shippers and carriers.

Convoy’s platform solves for all four of these issues:

(1) An Online Platform That Aggregates a Highly Fragmented Market

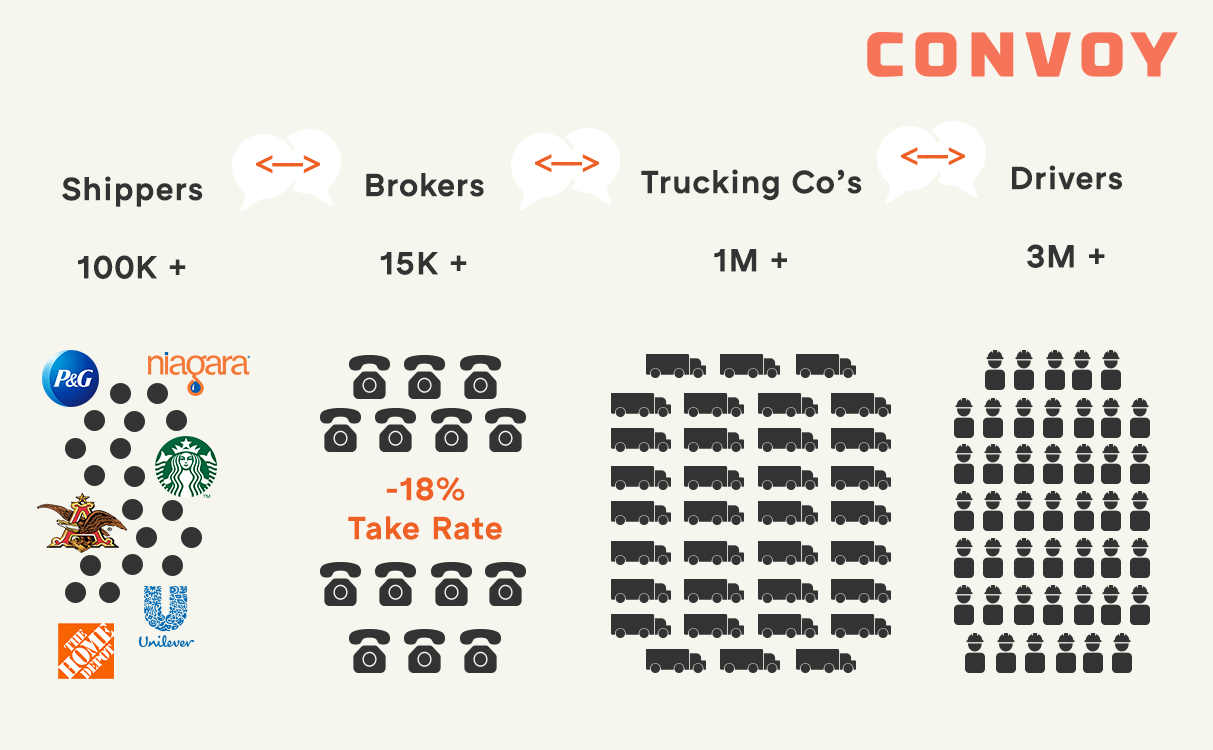

Fragmented supply and demand is a problem for incumbents, but a great opportunity for a digital marketplace. On the supply side of the US freight market, there are 1.6 million carriers, 95% of which operate 10 or fewer trucks2. On the demand side, there are more than 100,000 shippers3. A further source of complexity is the fact that some shipments require specialty vehicles such as refrigeration or flatbed. On top of all of this, many carriers operate regionally. Suppliers must build liquidity on a regional basis and then implement complicated logistics to move between regions.

To navigate this fragmented marketplace, shippers and carriers work with a multitude of brokers and sales reps. These middlemen find potential trucks, collect bids, and present the best match to shippers—all of which is typically done in spreadsheets, emails, and phone calls. In return, they collect 15–20% of the shipping cost. This unwieldy process drives up shipper costs and suppresses carrier earnings. But the alternative is to leave shippers and carriers to negotiate amongst themselves, which, given the fragmentation, is almost impossible without software.

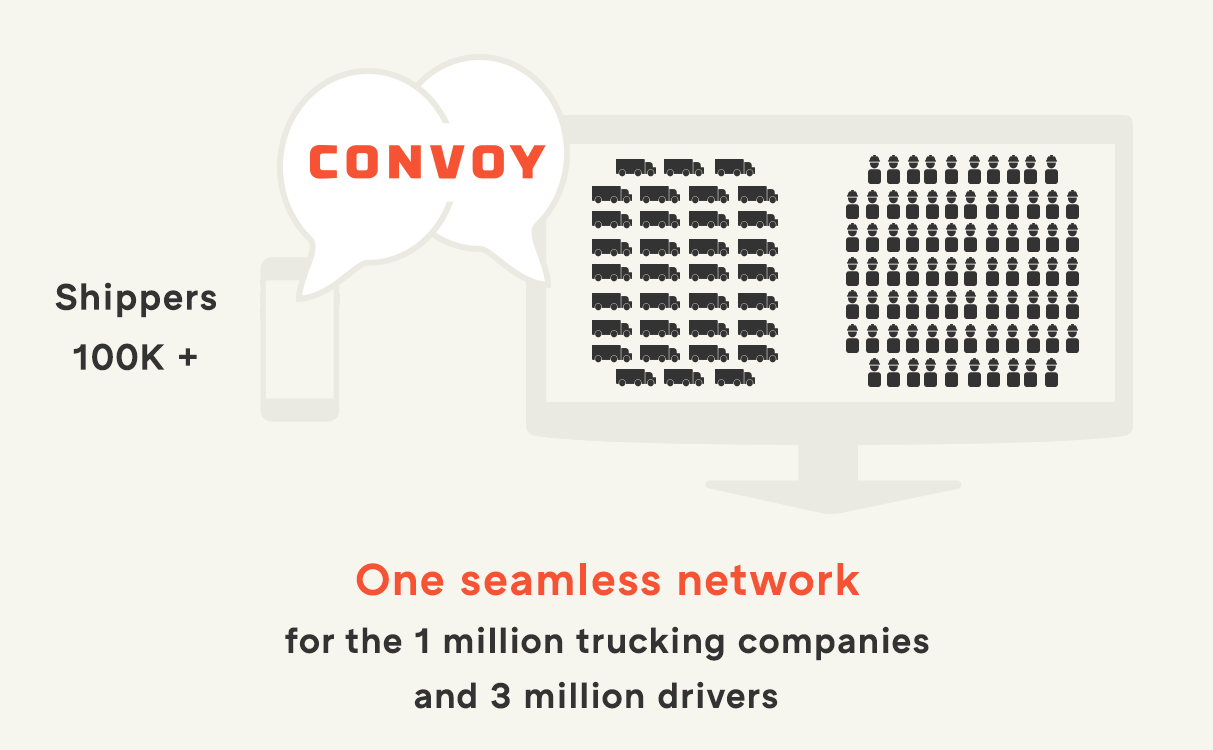

By building a network that aggregates supply and demand, Convoy has replaced middlemen with efficient algorithms. Complex matching logistics are becoming fast, seamless, and less costly. And, like many rich data marketplaces, the economics will only improve dramatically with experience and scale.

(2) Automated Matching Reduces Booking Time and Empty Miles

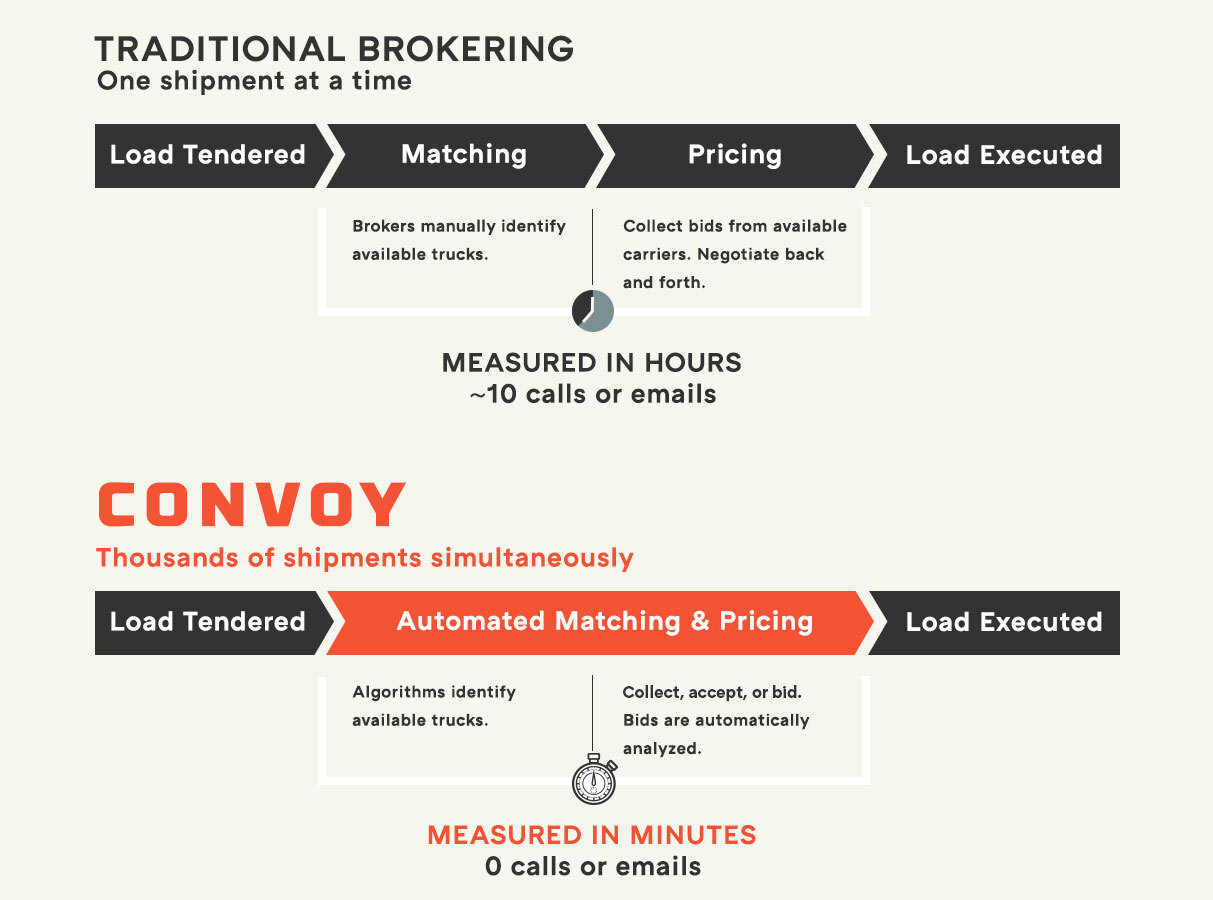

When matching a shipper to a carrier, brokers must take into account at least 10 attributes (e.g., origin, destination, type of truck, load, shipper, facility, seasonality, price per shipment, cost per mile, quality of truck carrier, mix of headhaul and backhaul). No human with a spreadsheet can manually optimize all of these criteria. It’s an extraordinarily inefficient system, with each match costing 1–2 hours and $40–80 per load4. On top of this, brokers are incentivized to maximize carrier margins rather than plan efficient routes. As a result, almost 35% of all miles driven by trucks in the US aren’t actually transporting any freight.

Convoy realized freight resembled the traveling salesman problem in computer science, and built software that incorporates shipment criteria with real-time supply and demand data to generate matches with the fewest empty miles at the lowest price. Today, Convoy automatically brokers 100% of loads in its top markets, bundles shipments on both headhauls (shipments to destination) and backhauls (shipments to return to origin), and optimizes for the shortest trip possible using software-driven scheduling and routing. To date, Convoy has:

- Eliminated the standard $40–80 of broker overhead per load for shippers

- Reduced matching time (the time it takes to match a truck to a shipment) from 2–8 hours to <1 hour in top markets

- Reduced empty miles from 35% to 19%, resulting in higher driver earnings and lower waste

- Improved carrier on-time rate from 85% to 92% by tracking carrier performance and shipment progress5

- Enabled many shippers to reduce the number of carriers and brokers that they work with

Convoy’s industry-leading key performance indicators will only get better with scale. As Convoy’s network grows, and efficiency and service advantages grow even further, it will be a no-brainer for shippers to move their business to the platform.

(3) A Strategy That Alleviates Systemic Supply Shortage

Freight matching is further complicated by the fact that the supply base is fixed. The number of truck drivers in the US has remained stable between 3 and 4 million since the early 2000s. Due to increasing shipping demand, regulations that limit driver hours, and a lack of young people joining the trucking workforce, the industry is experiencing a growing driver shortage. In 2019, the American Trucking Association recorded a shortage of 60,000 freight drivers. This number is expected to increase to 160,000 by 2028.6

Unlike ride-hailing services, Convoy cannot easily increase the number of drivers in the US. Trucking requires commercial licenses and special vehicles. But Convoy’s software-driven approach can help make trucking more attractive to new potential drivers in the long run. An online interface eliminates many of the barriers that discourage workforce entrants. Instead of calling multiple shippers or brokers for jobs, drivers can use Convoy’s mobile app to sign up and book their first load in under an hour. The process requires very little upfront financial investment or social networking by drivers or carriers. As a result, Convoy has enabled the long tail of owner-operator carriers that own 1–2 trucks to carry loads for large shippers. These small carriers now account for the vast majority of volume on Convoy, quickly building supply in the company’s operating regions.

To further amplify the existing supply base, Convoy launched Convoy Go, a network of preloaded trailers that can be picked up by any truck driver free of rental fees. By eliminating the need for drivers to wait around for trailers to get loaded and letting drivers flex across loads irrespective of their trailer type, Convoy is able to serve more enterprise shippers with fewer drivers.

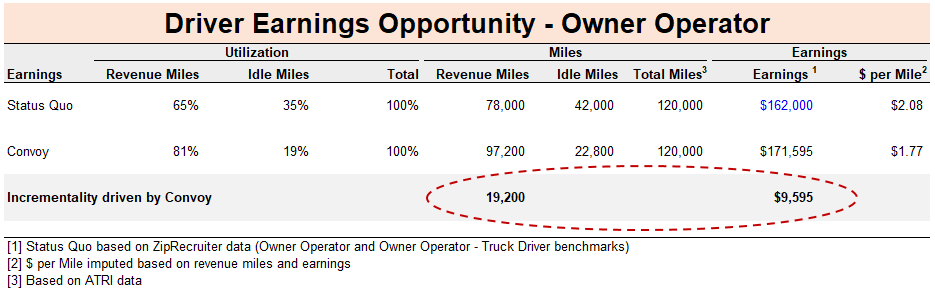

Most crucially, Convoy minimizes empty miles, which increases driver earnings. The company’s data suggest that drivers can increase revenue-earning miles by 25% by switching to Convoy7. Assuming the average driver logs 120,000 miles per year, Convoy can increase each carrier’s annual earnings by ~$40,000 with a negligible increase in their operating costs8. These economics will get even better as Convoy scales its network. Looking at other on-demand marketplaces, we’ve learned that supply follows the money. Higher salaries will both attract new drivers and influence existing drivers to prioritize Convoy shipments.

(4) A New Pricing Model Enables Better Options in a Volatile Market

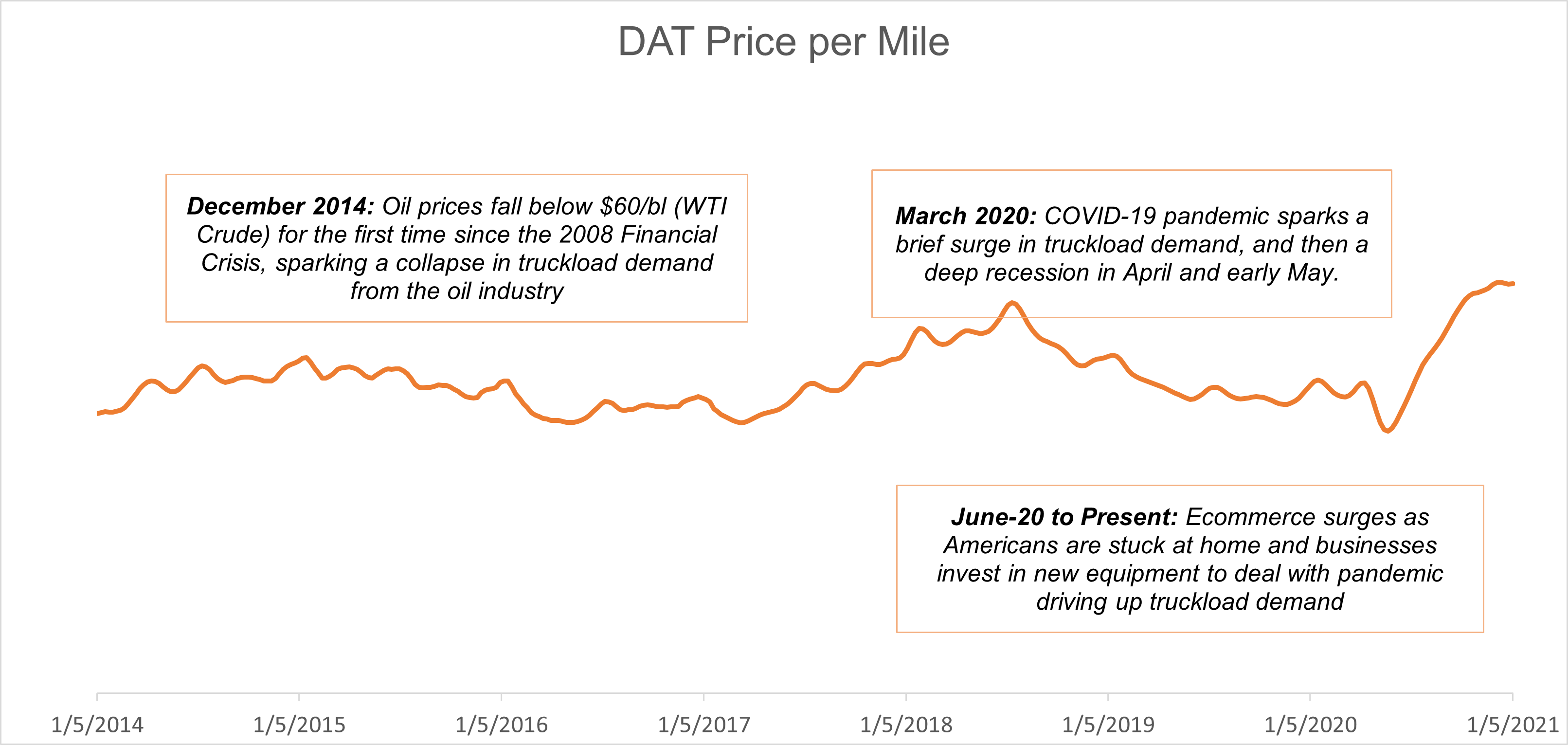

Freight pricing is more volatile and less predictable than the stock market. Prices move up and down with macroeconomic events and changes in supply and demand, and there is nothing resembling a flat shipping rate. The COVID-19 pandemic caused a surge in demand, pushing freight pricing per mile to increase 56% in the last eight months alone9. Historical price data from DAT Solutions, a widely used data source in the industry, show freight pricing volatility over the past several years:

Pricing volatility makes it extremely difficult to forecast business outcomes, which can cause margins to swing for carriers, shippers, and brokers. To navigate volatility, the freight industry uses two pricing methods: contract pricing (used by 80% of the market) and spot pricing10. With contract pricing, a shipper agrees on a fixed price for a guaranteed volume of loads with a specific carrier for a fixed period (usually 12 months). Spot pricing is set case-by-case, based on the market clearing price 48 hours before a shipment.

High-volume shippers prefer contract pricing to guarantee reliable shipping and lock in costs. But this predictability comes at a cost: contract freight charges as much as a 7% premium. This premium is rationalized by the fact that contracts rarely go as planned. Even with contracts, carriers turn down loads or renegotiate terms in the face of extreme market changes (e.g., COVID-19 or a hurricane that wipes out supply).

Pricing complexity is exacerbated by the fact that brokers are not incentivized to share rates with shippers and carriers. A broker earns 15–20% on every transaction—the higher the transaction cost, the higher the broker’s earnings. This cost is passed onto the shipper, the carrier, the driver, and eventually the consumer.

Convoy is flipping the freight business model on its head. Instead of charging a fee, Convoy’s revenue model is based on the spread between the shipper’s willingness to pay and the carrier’s pricing expectations on that route. Using software, they’re able to provide a cost estimate to shippers and run an auction on the carrier side. This eliminates the 15–20% brokerage fee, lets shippers and carriers work with fewer counterparties, and improves pricing visibility.

Secondarily, Convoy guarantees supply to carriers while minimizing administrative overhead (e.g., RFP processes). Instead of pricing on a fixed rate per mile, Convoy agrees to a fixed margin with a shipper and guarantees that all loads will be tendered. This eliminates the need for contracts and provides partners with upfront, transparent pricing (as well as a clear picture of their savings).

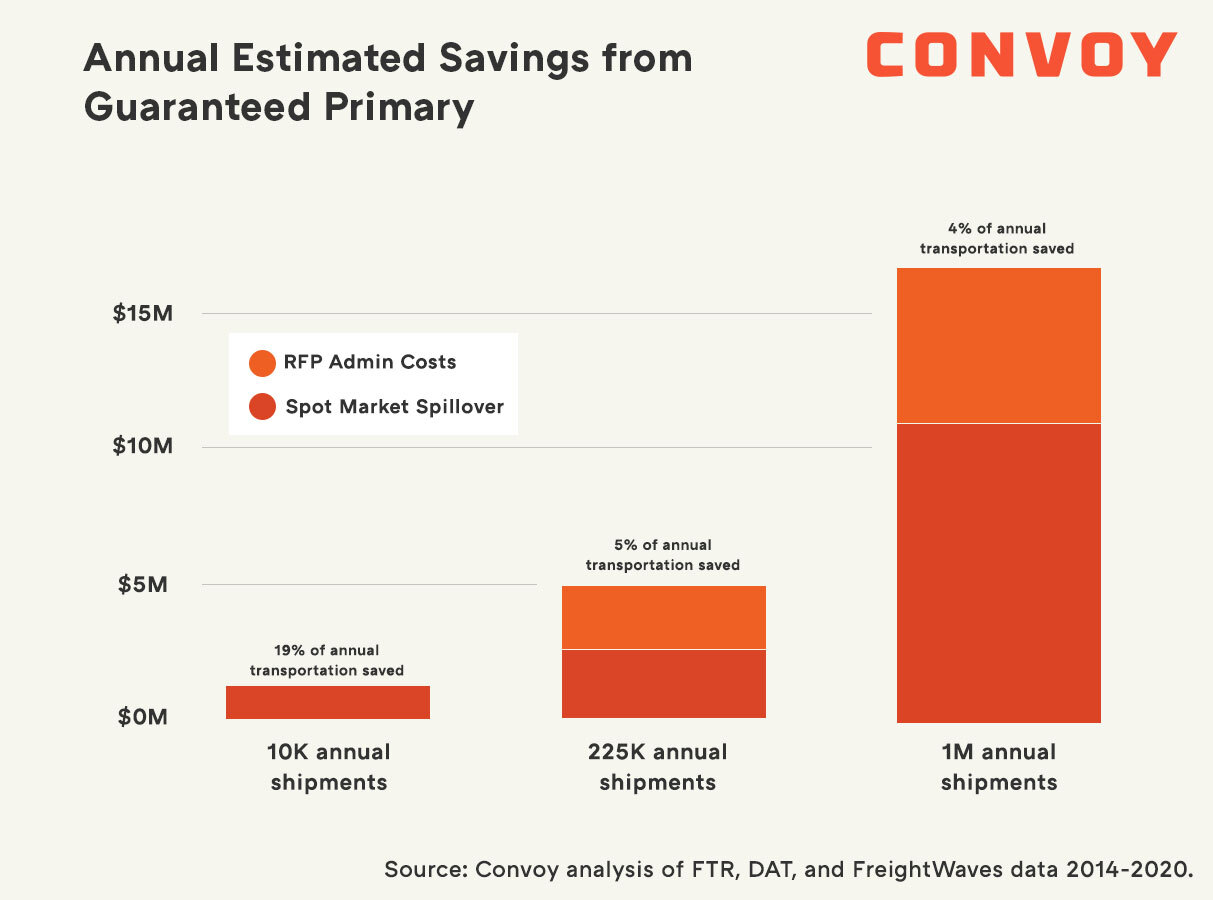

Enterprise shippers like Home Depot like this model because it reduces administrative costs and spillage onto the spot market. Small shippers like it because it guarantees loads and eases the pricing burden on the spot market. Convoy can reduce annual transportation costs for shippers of all sizes by 4–19%—while also reducing the risk carriers take on contract pricing11. This is just an example of one offering called Guaranteed Primary, one of 6-7 pricing/volume commitment models used by Convoy to tailor to shippers’ needs.

The Problem of Scaling

The specificities of the freight marketplace make implementing and scaling more complex than other online marketplaces. Unlike Airbnb, where guests are usually only looking for one home at a time, a large shipper is looking to ship across multiple lanes simultaneously (e.g., an enterprise shipper is looking to ship from Chicago to Tampa, Houston to Boise, Boise to Tampa, etc.). In other words, Convoy had to be everywhere and get big fast.

Convoy’s initial strategy was to support only two large shippers. Instead of launching nationwide, Convoy narrowed its focus to these shippers’ highest-volume routes. There are ~2,000 trucking lanes nationally, and 60% of freight moves through the top 10% of those lanes. Convoy prioritized the top 10% of lanes serviced by the two large shippers. Once Convoy had enough demand to service loads, they used bookings to attract more supply in those lanes. As supply grew, Convoy scaled its capacity to take on other large shippers in these same routes, and eventually shippers of all sizes in additional routes.

In most marketplaces, aggregating demand is a lot harder than aggregating supply. Supply naturally gravitates to the platforms where it can make money. This was true for Convoy as well, but acquiring supply was more difficult because of geographic fragmentation. Even with two shippers in their top 10% routes, Convoy still had to solve the problem of traversing multiple regions simultaneously. This was no easy task for a young startup with limited resources, but Convoy stayed focused and it paid off. Within three years of launch, the company had five large shippers, nearly 500 smaller ones, and was growing more than 30% month-over-month.

The Flywheel and Unit Economics

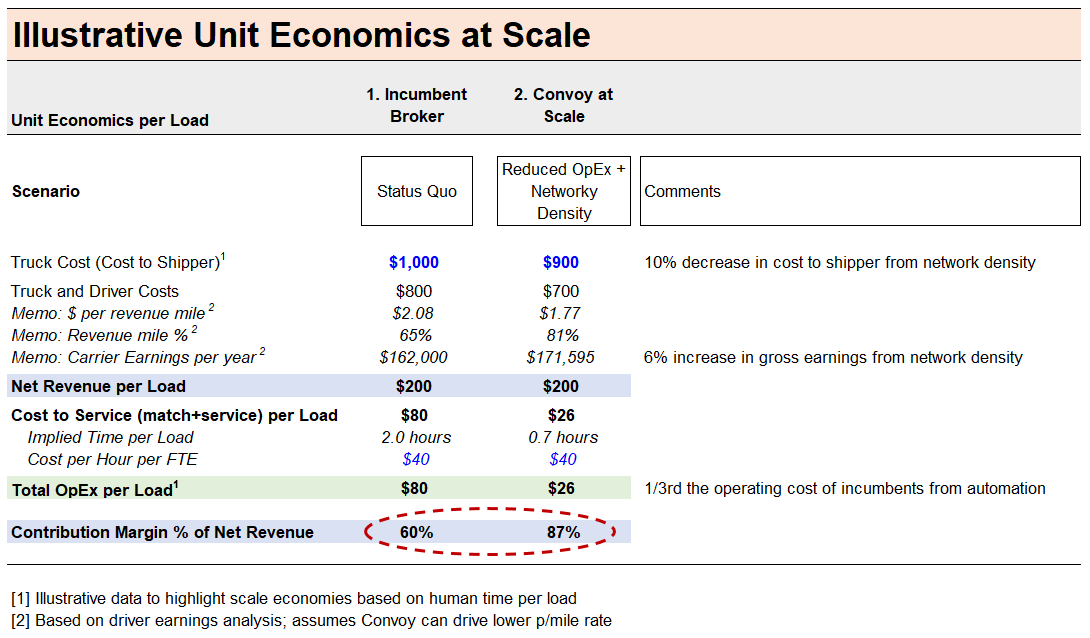

When we met Convoy, even though the company was growing quickly, it was still trying to make the unit economics work (the contribution margin was negative on each load). We invested anyway. As Hamilton Helmer outlines in 7 Powers: The Foundations of Business Strategy, it is important to look beyond short-term economics to long-term potential. We believe that Convoy’s model will create outsized returns as it scales its unique strategy.

Convoy’s automated matching and servicing translates to lower operating cost per load and higher long-term cash flows. Today, Convoy’s operating cost per load for enterprise loads is about one-third of incumbents’ operating cost per load. The advantage is durable; legacy shipping giants like CH Robinson scale with mostly manual operations, and new entrants lack the scale to match the costs. As Convoy continues to grow, neither incumbents nor new competitors will be able to match its low operating costs.

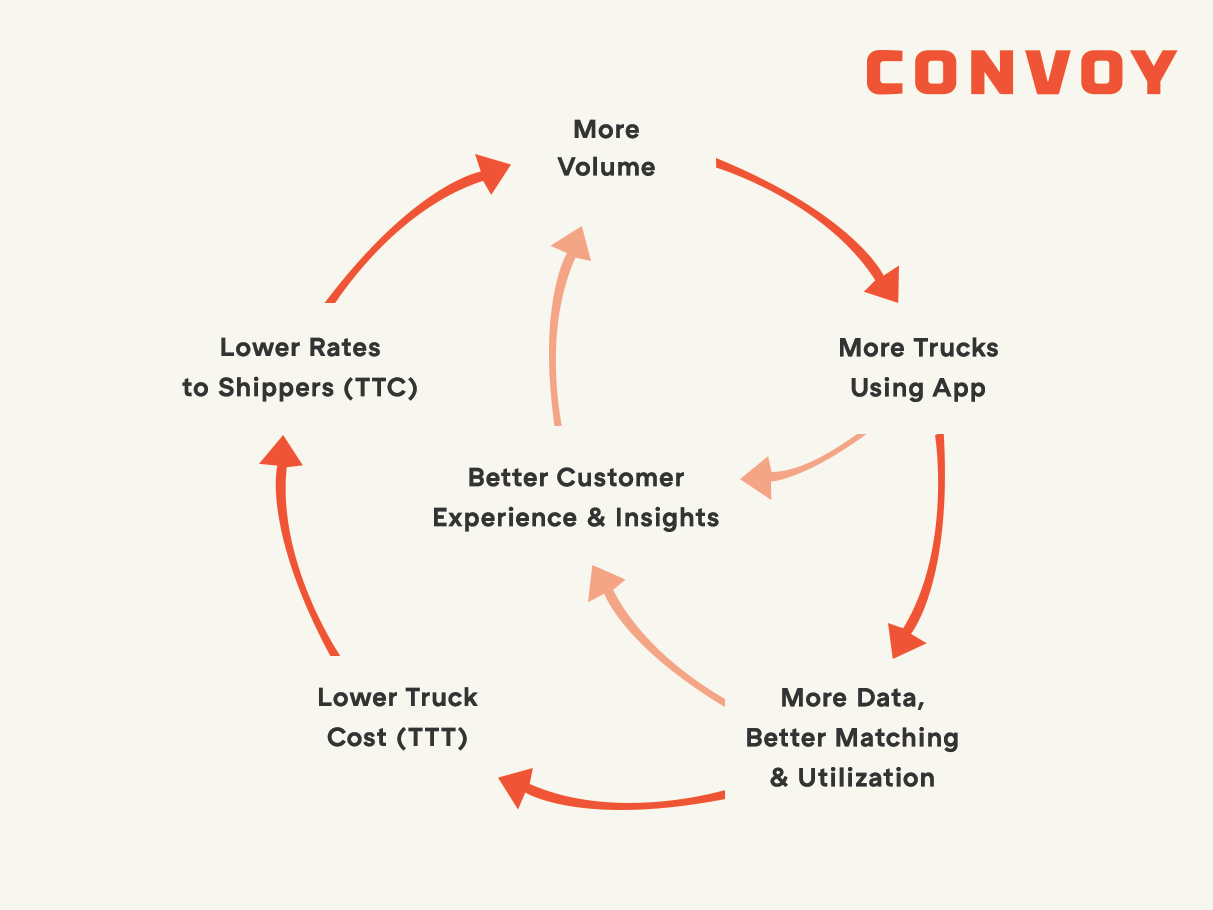

Convoy’s business also benefits from a powerful flywheel that drives scale benefits. As more drivers join the network, more shippers’ needs are met, and vice versa. More load volume leads to more data to optimize batching and better match rates, which in turn lowers shipper costs while also increasing utilization and driver earnings. Incumbents who have built their businesses on 15–20% take-rates will not be able to match Convoy’s pricing without sacrificing their own unit economics.

Convoy: The Future of Truck Freight

We cannot overstate the opportunity Convoy presents. Freight is a critical industry that is only getting more important in the face of work from home and online retail trends. In a status quo scenario, increased shipping demand might trigger prohibitively high prices, leading to large scale economic consequences once those prices are reflected in the consumer market. In contrast, Convoy is in a position to make the industry more efficient. In the long term, this isn’t just convenient; it’s necessary.

Today, Convoy’s scale is already substantial; it moves freight across the entire country and has expanded to thousands of shippers. In the near future, we expect that its network-driven approach will enable the company to capture billions of dollars of value while reducing overall freight spend and increasing driver earnings. Much like DoorDash in food delivery or Airbnb in hospitality, we believe it is only a matter of time before Convoy becomes a market leader in freight.

While Convoy is leading the way, freight’s offline to online transition is still in its early days. Within the YC community, we are starting to see other companies approach freight from first principles. Kobo360 (S18) is building a to improve inter- and intra-region freight in Africa. RoseRocket (S16) is building software for carriers and brokers to improve connectivity with shipper partners. TrueNorth (W20) is building tools for carriers to better manage their businesses. Combined, these companies will transform the way freight is moved in the US and globally.

Thank you to Aaron Terrazas, Chloe Gordon, the entire Convoy team, and to Mia Mabanta at YC, for reviewing this essay.

Notes

1. American Trucking Association ↩

2. FMCSA Registration Statistics ↩

3. Convoy data ↩

4. Per BLS, the average hourly wage for brokers is $26.50 ($40.15 including non-wage benefits). Assuming 1–2 hours of human time and $40.15 of cost per hour, it costs a traditional broker $40–80 per load for matching. Note: Shippers can use load boards, but these are used for a minority of loads and give carriers limited shipment visibility. ↩

5. Based on qualitative feedback from shippers ↩

6. American Trucking Association 2019 Driver Shortage Report ↩

7. convoy.com/blog/empty-miles-in-trucking ↩

8. ATRI ↩

9. Historical DAT freight pricing data ↩

10. freightwaves.com/news/what-is-the-difference-between-trucking-contract-and-spot-rates ↩

11. convoy.com/blog/introducing-guaranteed-primary/ ↩

Other Posts

What startup hiring looks like in 2021 — and during a pandemic

January 17, 2022 by Ryan Choi

Author

Anu Hariharan

Anu is a Managing Director & Partner at YC Continuity. Previously, Anu was a Partner at a16z, where she worked actively with the management teams of companies including Airbnb, Instacart, and Medium.