Ruleset - No-Code Decision Engine for Lenders

We empower risk and legal teams to set rules for who gets a loan, without requiring engineering.

Hey all, we’re Logan and Zheng building Ruleset!

❌ The Problem and Why It Matters

Financial firms have a decision process that determines who qualifies for a loan or not. Even firms using machine learning only have the ML model as one step.

The problem is that these rules are defined by Risk and Legal teams. However, they are implemented by engineers who don’t fully understand them, and getting them wrong costs companies millions.

⚙️ How It Works

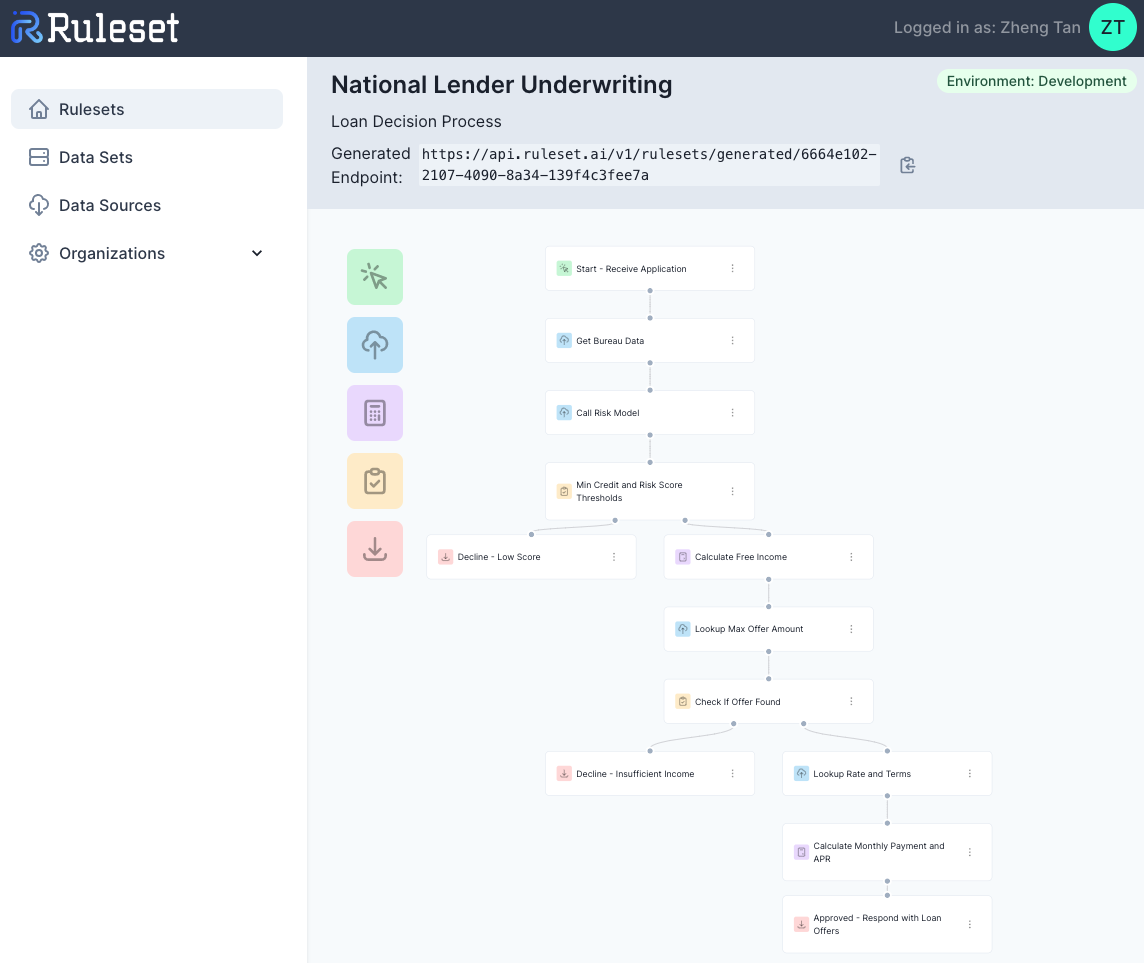

We provide a drag-and-drop interface which makes it easy to create a decision workflow from a basic building blocks. These “rule” components can read/write from data sources, do calculations, and fork data paths for different outcomes. For our customer’s tech teams, integrating a Ruleset into their systems (to display the results on their website) should be as easy as plugging in Stripe.

❓Why Are We Working on This?

The idea clicked when I was recently at Regional Finance (NYSE: RM) launching new online lending products. I experienced this problem alongside our Risk and Legal teams, where an evaluation of existing vendors didn’t find one which could quickly and easily solve our issues. Zheng and I previously worked together for two years at a Series A startup and knew we could build the right solution.

🙏 The Ask

If you or someone you know works in Risk, Legal, or Operations at a financial firm, or if you’ve tried other decision workflow tools and they didn’t solve your problem, shoot me an email at logan@ruleset.ai and I’d love to discuss how we can help!