Anchor - Banking as a service platform for Africa

Build accounts, cards, savings and payments into any app! 🚀

Hey YC Fam! 👋

Segun, Olamide and Gbeke here to introduce Anchor!

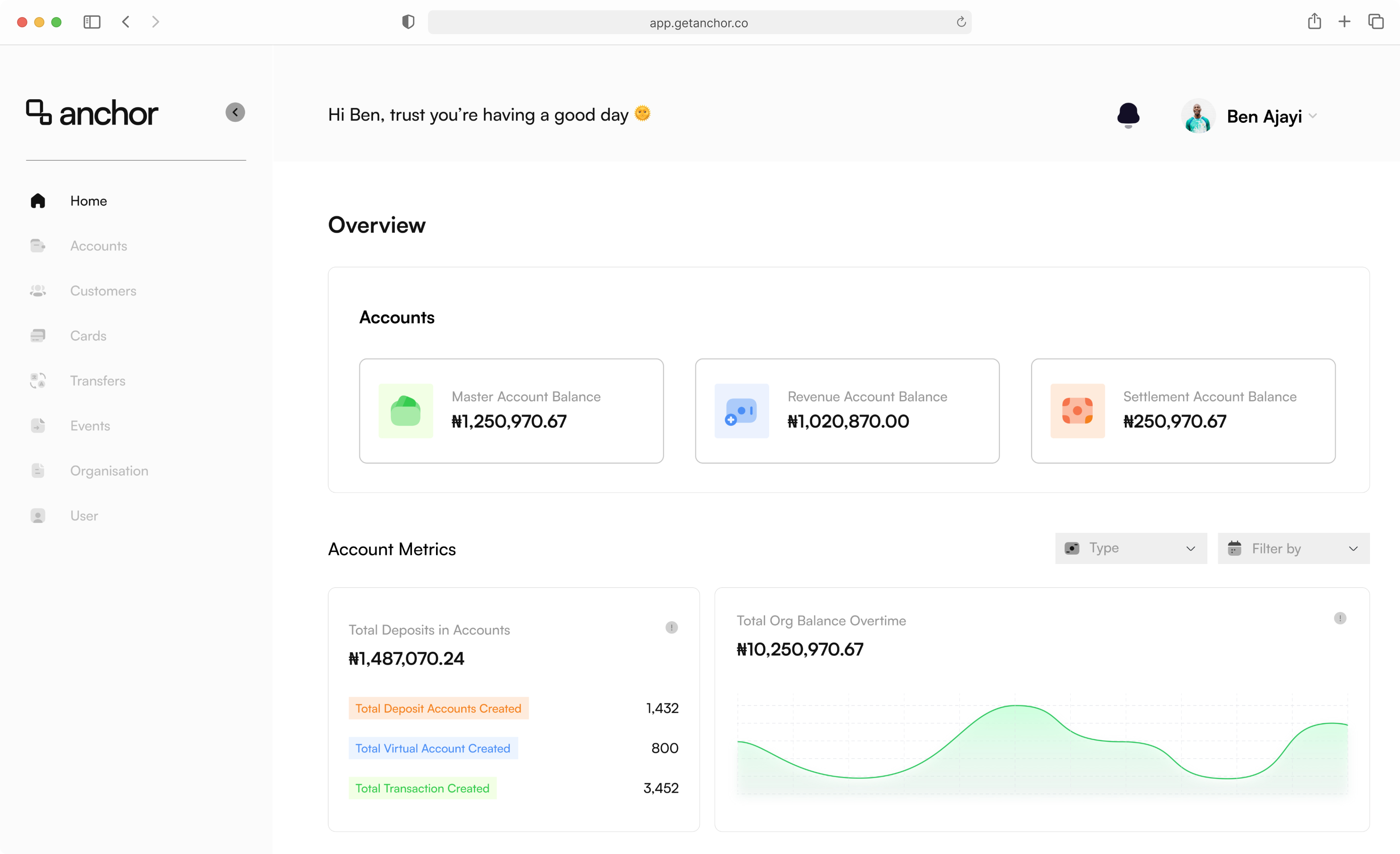

TL;DR: Anchor makes it easy to offer accounts, money movement, savings and card products in Africa. We provide APIs, dashboard and regulatory support for developers to build, embed and launch banking products.

Check out our documentation here & request invite here.

We released our private beta in May. We’ve signed-on 30+ companies including the largest telco in Africa and YC companies like Fingo, Pivo, Tizeti, Curacel, etc.

Why we built this

Across Africa today, businesses spend ~$0.5m and wait 18months before they can go to market with simple banking products.

This is because they have to cross many hurdles including:

- rigorous licensing and compliance processes;

- build many integration layers;

- manage complex banking and third party relationships; and

- invest in complicated core-banking infrastructure

As founders, we witnessed these pain first-hand in our experience building and working with fintechs.

We built Anchor to abstract away the complexities, so businesses can get started in 5minutes with a few lines of code.

Who we are

We are repeat founders with experience in the fintech space. Segun sold his previous payment company to Carbon and worked at JUMO. Olamide & Gbeke have worked with top African fintechs like Kuda, Carbon, and TeamApt, and global tech giants like Google and Booking.com.

Our ask 🙏

- Contact us if you want to offer wallets, accounts, cards or savings products to your African customers.

- Connect us with digital businesses (fintechs, Saas companies, marketplaces/e-commerce platforms, etc).

[*** Quick forwardable blurb**: A team of YC-backed, fintech engineers recently released an API to help developers build banking products. Check them out at getanchor.co and contact founders@getanchor.co]