DailyPe - Repay your loans daily

DailyPe is a marketplace for business loans, that are repaid daily.

Hey! We are Saurabh and Shashwat, the founders of DailyPe. We met each other at IIT Kharagpur and have been friends for the past 7+ years. We’re building DailyPe — a marketplace for business loans that are paid in smaller, daily installments.

—

Problem 💸: Paying your loans in huge installments at once sucks.

Small shop owners earn daily unlike salaried people, but when it comes to loan repayment both are asked to pay monthly. For these shop owners, it is difficult to calculate how much to save each day so that they will have the required installment amount at the end of the month. Also, at the time of repayment, they end up with a big hole in their working capital.

Solution 💡: Reduce risk & pay small amounts daily.

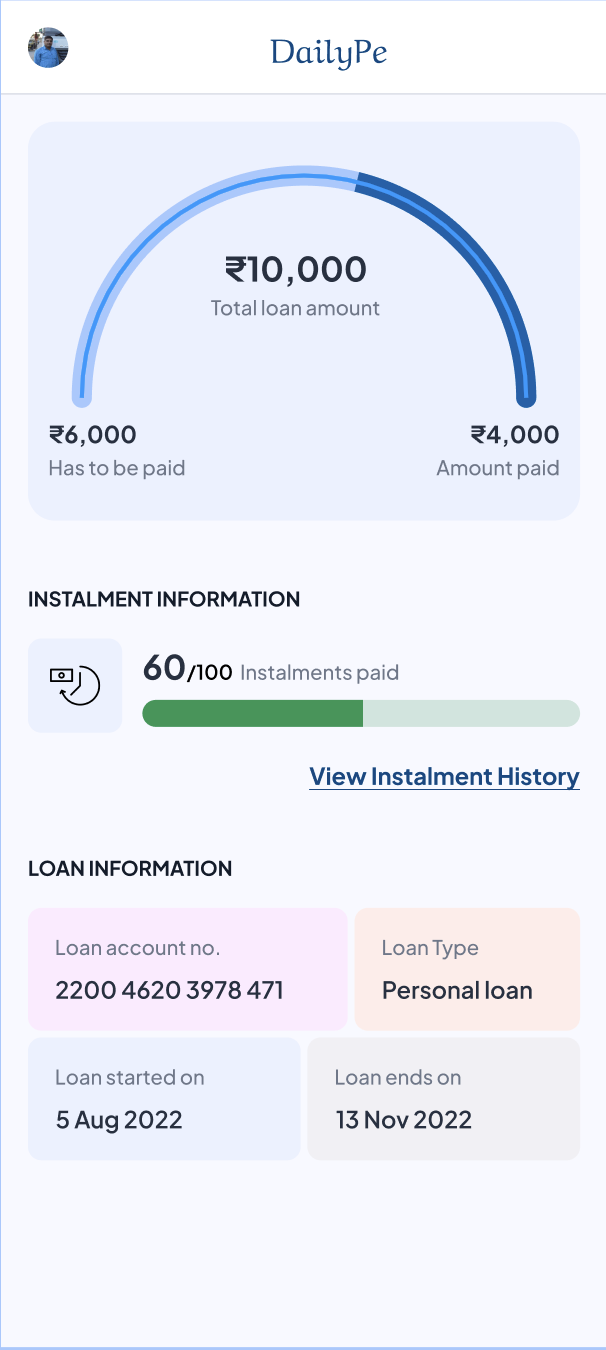

Borrower Side: When you earn daily you pay daily and get away from the stress of huge one-time installments. Each day, a small amount of $X is deducted from your digital wallet which is on the auto-debit mandate and you don't need to worry about keeping your balance of $XXXX. You never default, and you also build your credit score.

Lender Side: Discover defaulters early because right from the 2nd day onward, your collection data stops you from lending in that particular demographic and geographic location. These data points wouldn't be available in the traditional way of lending till at least the 3rd month. With DailyPe, lending decisions are much more informed leading to higher collection rates and lower NPAs.

Why us 😎

We both have seen this problem firsthand when our fathers, who ran their own businesses, would stress out days before installment day — saying that they “**need to save and transfer money from their secondary accounts to pay for the loan.**”

Also, while working at FinBox and ICICI bank in the past, we built products in the lending-tech industry. This was something we had always wanted to build.

Fun fact: These loan products are called “khandi Udhar” which existed for a long time in the unorganized markets in India. We are making them organized 😁

Ask ❤️

Lending Partners: If you can connect us with banks, NBFCs, and debt institutions in India who are open to becoming finance providers for our small business owners.

Data Points: If you have worked on credit models, underwriting tech, risk analysis, or any sort of lending algorithm, please reach out to us at founders@dailype.in. It would be a pleasure to learn from you.