Eden Care - Digital health insurance for employers in Africa

Saving employers time and money with better, cheaper health insurance

Tl;dr: Eden Care offers digital health insurance to employers in Africa. We are making health insurance cheaper by building a new tech stack that reduces the cost of insurance operations by 43%. In 6 months since launch, we have $2.1M in gross premiums and growing 100% month-on-month. Check out Eden Care today.

—

Hello, I am Moses Mukundi, and my team and I are building Eden Care. We are on a mission to provide access to affordable quality health insurance to the 90 million uninsured African employees. See some of our team below:

Problem: Underserved

African insurance cost of operation (claims, distribution, and fraud cost) is 2.2x the global average resulting in expensive insurance. No wonder, health insurance penetration in Africa is 0.2%, 15x lower than emerging market peers.

This $11 billion industry hasn’t modernized (manual, limited customer insights, and high fraud waste and abuse) and has largely focussed on large companies and high network individuals, leaving out the majority of Africans. There’s a need for a new solution for Africans to increase health insurance uptake.

Our Solution: Digital infrastructure that automates the entire value chain

Eden Care is a full-stack licensed health insurer. We are building a new tech that reduces our cost operation by 43% resulting in cheaper cover.

We have deployed tech infrastructure across 3 main users - HR& admin teams, employees, and healthcare facilities. This enables us to automate the majority of our processes reducing cost but also improving customer experience.

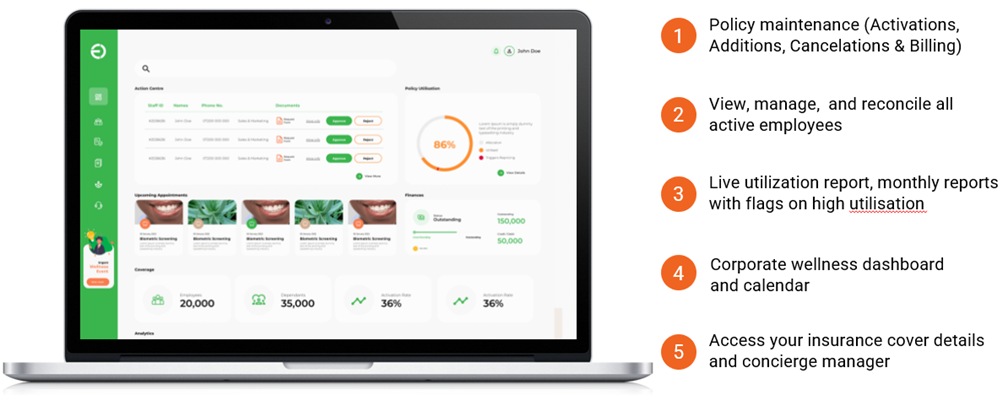

For HR teams, we provide them with a portal to easily manage the health benefits of their team.

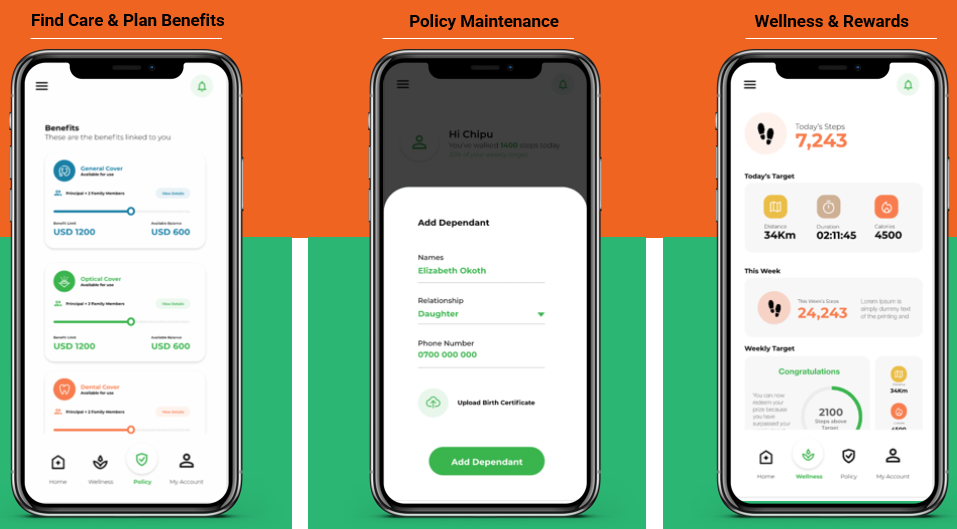

For employees and their dependents, we provide them with an app that helps them access and navigate healthcare, participate in Eden Care’s wellness and prevention program, and earn/redeem rewards.

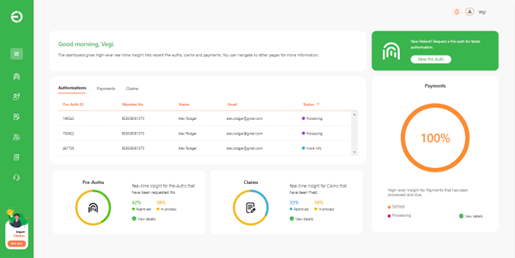

For service providers, we have provided an end-to-end digital tool that enables them to quickly serve our members and digitally complete all their processes on our system — eliminating the majority of manual processes and paper, automating the majority of the tasks, and saving time and money.

With this data-rich view, we can:

- automate >90% of all back-end insurance processes enabling us to deliver real-time decision-making and personalized health nudges

- intervene at the point of service to prevent fraud, waste, and abuse

- deliver better underwriting and products more relevant to user needs.

- Develop AI tools to improve stakeholder experience while lowering ops cost even further

The opportunity: Right time to build Eden Care

- 22 Africans will transition to middle-income status by 2030. This transition is associated with a 7x growth in health insurance spend.

- SMEs are formalising at a faster rate and buying insurance for their teams for the first time. This is the largest insurance opportunity in Africa and is where Eden Care is positioning itself to be the segment leader.

- Rapid digitisation of healthcare facilities and end users is for the first time enabling the deployment of end-to-end digital health infrastructure.

- 310 million Africans will be middle class by 2030. The majority are young digital native families buying insurance for the first time. Eden Care is becoming the default insurer for this group.

Ask: How you can help us

- Share this post! Please help spread the word, as you never know who it may help.