iNRI: Wealthfront for 32M Indians living abroad

Investing in India made easy for Indian expats

Hi all,

We’re Hemant and Nishad, building iNRI, Wealthfront for 32M Indian expats abroad.

India is set to be the fastest-growing major economy and Indian expats have a unique opportunity to invest in this dynamic growing market. However, for an Indian expat looking to invest in India, it is still a daunting experience, with multiple operational hurdles, and complex tax and repatriation regulations.

Inri solves these challenges by providing a seamless investment platform with personalized wealth advisory and tax compliance services.

Here’s a short video explaining what we do:

Our journey so far:

Since inception in March 2023, we have crossed over $150K invested capital from 3000+ users across 30+ countries including the US, Canada, UK, and Australia.

We provide 3 key solutions that non-resident Indians need to invest in India:

-

Faster and digital onboarding: Existing processes require either physical paperwork or even in-person visits in India. In comparison, you can get started with iNRI in just 5 mins, completely online.

-

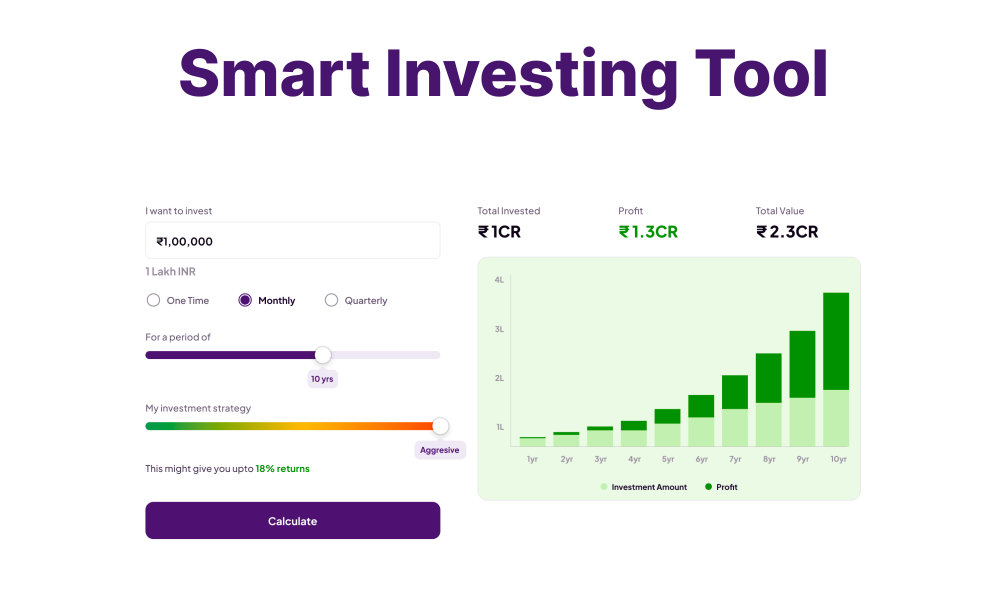

Curated portfolios: If you have been living outside for a few years, you don't know where to invest. Our smart investing tool (image below) helps you generate a funds basket based on your investment horizon, capital allocation, and risk appetite.

-

Cross-border compliance: Navigating taxes across two countries is hard, which is why we have a network of CAs, CPAs, and experts in cross-border taxes to help you.

iNRI’s vision is to become a one-stop platform for the Indian expat community of all things money in India.

Why Us

We (Hemant and Nishad) have both seen these problems firsthand through our own experience and that of our friends looking to invest in India. We’re committed to solving it for the broader Indian expat community around the world.

We are both alumni of IIT Bombay and IIM Ahmedabad and have a decade of experience working at McKinsey, BCG, Meta, Walmart, and HSBC.

If you’re an Indian expat looking to invest in India, check us out here.