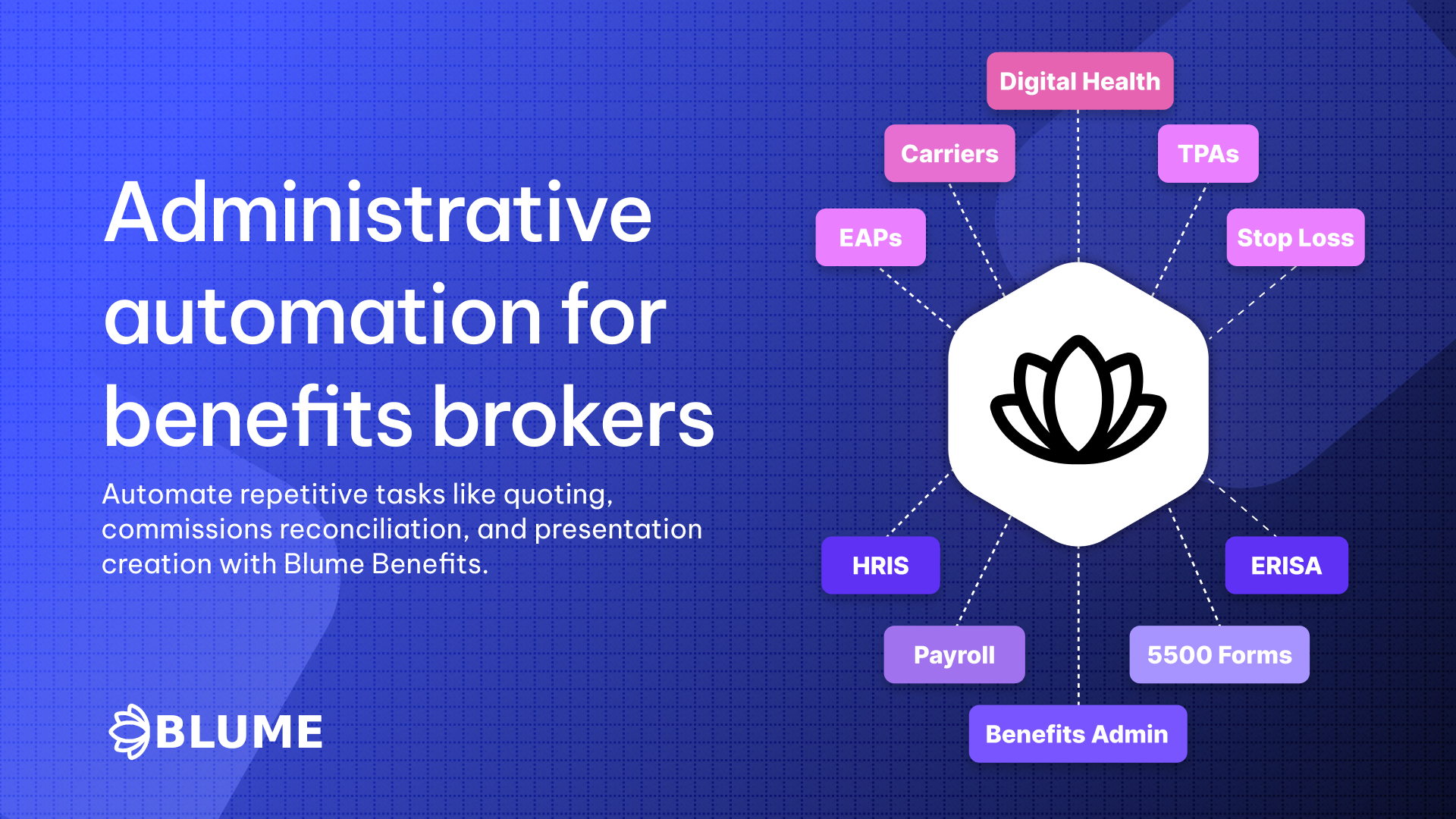

🌻 Blume: Back Office Automation for Health Insurance Brokers

A unified data platform for brokers to scale their book of business.

Hey everyone! We’re Aditya, Ethan, and Varun building Blume Benefits.

TL;DR 📌

Blume Benefits automates health insurance sales for brokers. Today, health insurance brokers spend an average of 11 hours a week on manual data entry. Blume helps brokers manage quotes, renewals, and revenue ops all in one place without having to manually enter a single keystroke of data.

The Problem ❌

Obtaining health insurance is such a complex task that a $104 billion-dollar industry exists to help employers navigate the buying, negotiating, and administering of health insurance for their employees.

Health insurance brokers, the stewards of these transactions, have to manage thousands of complex relationships every year. From negotiating commissions and quotes with insurance carriers to managing contract renewals and compliance for their clients, health insurance brokers find themselves using a fragmented set of programs to store and manage all of this information. Constantly, data and reminders fall through the cracks resulting in thousands of dollars in lost commissions, botched renewals, and an artificially capped book of business.

The Solution ✨

Blume was created to streamline the relationships that brokers have to manage with their clients and the insurance carriers they work with. On Blume, brokers can:

- Turn unstructured quotes into presentable and understandable formats for their clients.

- Automate insurance carrier commission statement reconciliation and revenue recovery.

- Consolidate information about their customers to prioritize their work, ensure no clients are left underserved, and catch problems with plan designs before employees run into them in the clinic.

By consolidating all of these tools, we are building toward a world where health insurance brokers spend all of their time helping their clients navigate the complex world of health insurance rather than manually keying in data to Excel, spending hours every week consolidating claims data into actionable insights.

Why we built Blume 💼

Over the last few months, we had the opportunity to speak with more than 150 health insurance brokers. One thing was clear, they all were frustrated with the decreasing amount of time they could spend helping their clients due to the growing administrative burden and knew that something had to change. When we set out to find existing solutions to their problems, we saw user interfaces that hadn’t changed in years, manual workflows that increased reporting responsibilities for brokers, and software built to be sold to agency executives, not to be used by individual brokers. We are excited to address these issues with Blume.

Our ask 👋

We’re looking to connect with health insurance brokers looking to grow their book of business. If you are one, know any, or can connect us to yours, please feel free to reach out at founders@blumebenefits.com.