🪄 FlyCode: Recover failed payments with AI to increase ARR growth ✨

If you sell SaaS or B2C subscriptions, we’re here to help you recover lost revenue due to failed payments and involuntary churn.

Hey YC Community 👋

We’re Jake, Etai, and TD and we’re building FlyCode.

TL;DR: If you sell SaaS or B2C subscriptions, we’re here to help you recover lost revenue due to failed payments and involuntary churn.

‘Involuntary’ or ‘Passive’ churn is a hidden Revenue Killer 💳 for Subscription Businesses

20%-40% of a Merchants ARR is lost due to payment failures, errors like insufficient funds or processing errors. Most rely on brute force or fixed-interval retry strategies, a legacy approach that ultimately reduces retry success rates and increases customer churn.

❌ THE PROBLEM: Recovering Failed Payments is Complex

Involuntary churn refers to the loss of subscribers due to payment failures, not due to them actively canceling. While it is both possible and a worthwhile strategy to attempt to win back a customer during the cancellation process — involuntary churn is not intentional and in most cases, your customers aren’t even aware that their payment failed.

💰 Bottom line?

Effective payment optimization does reduce involuntary churn and will increase ARR by as much as 5-10%

🎟 What causes payment failures and involuntary churn?

There’s no single cause of this problem that can be isolated. In fact, there are dozens of reasons [insufficient funds, fraud, expired cards, AVS, SCA, invalid card, etc.], and solutions to each failure need to be applied individually. Let’s look at a few examples:

- Batch Processing and Fixed-Interval Retries. The majority of subscription payments and retries are processed in bulk during off-hours. If your customers are based in multiple time zones, this can increase payment failures and reduce the success rate of retries. Remember when you had to notify your bank when you were traveling? The concept is the same, a 3am charge is more likely to get flagged as fraud than a 9am charge.

- Expired Cards or Invalid Card Numbers: These are frustrating because you think you have to ask your customers to do something, surprisingly there are many cases when you don’t. When you lose a credit card and replace it, do you ever wonder how Netflix still manages to charge you? It’s all thanks to Card Account Updater and Network Tokenization — if you don’t have it implemented, it’s an easy win.

- Customers with Insufficient Funds: Timing is a critical factor, especially with these types of errors. If they don’t have funds, don’t force it. When retry attempts are spread out or targeted around periods of the month when cash inflow is expected, success rates will go up.

- Payments that are incorrectly classified as fraud: This can cause financial losses, as well as a negative impact on customer experience. It is important to prevent those legitimate payments from failing.

-

FLYCODE SOLUTION 💡

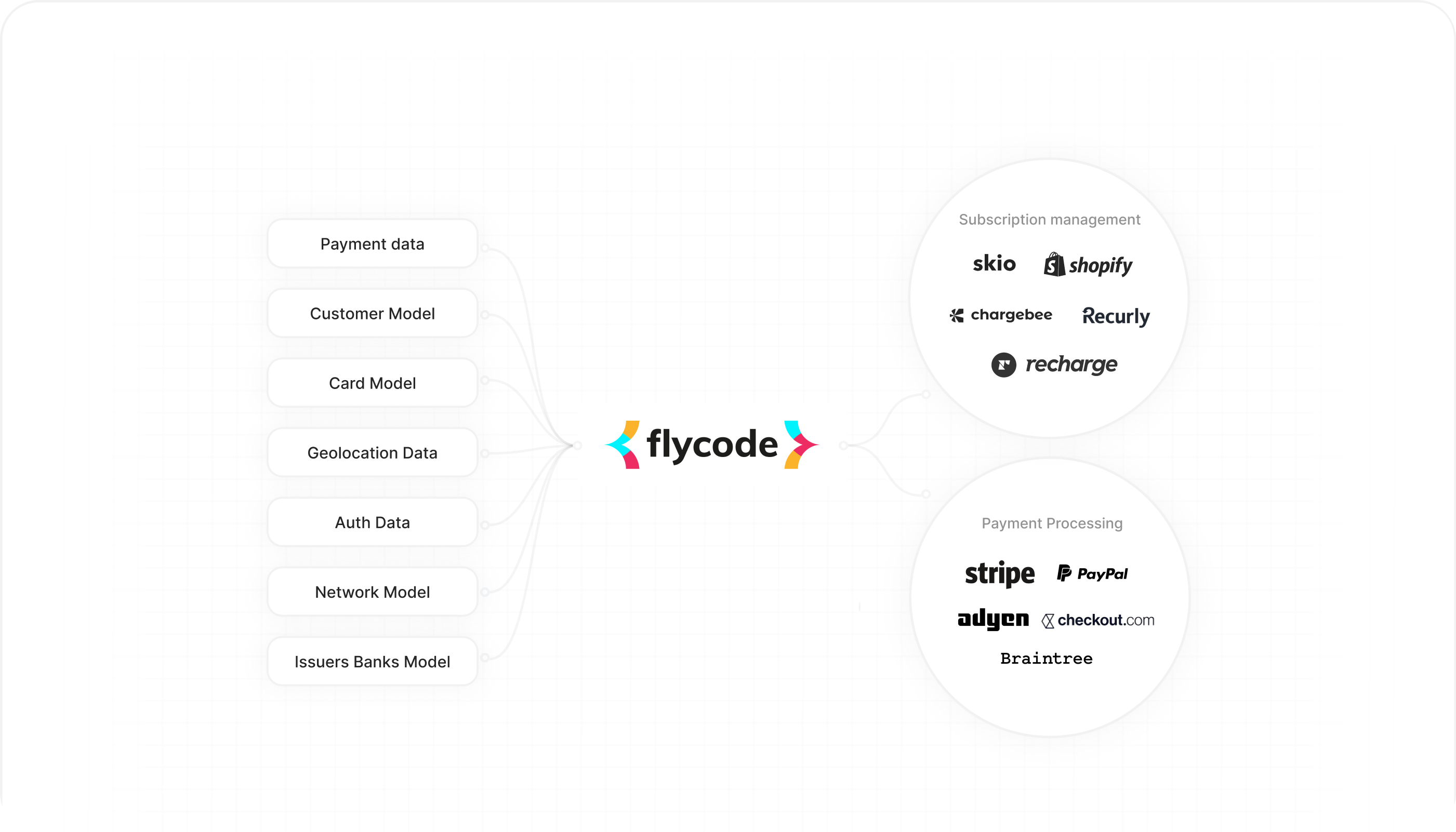

FlyCode leverages ML and AI to provide Payment Optimization and smart payment retries to maximize subscription revenue and reduce churn. We apply a unique model tailored to each Merchant and their customers to ensure optimal results.

⚡️Automatically recover failed subscription payments and reduce passive churn

⚡️Use ML & AI based payment optimization to find the best time to charge your customers

⚡️ Improve customer experience by coordinating payment retries with customer emails/SMS

🛠️ We support OOTB + Custom Integrations for Merchants and White-Label for Platforms

We’d love your support 🍻

- [FREE] 🎯 Let FlyCode analyze your payment health and show you how much revenue can be recovered https://www.flycode.com/churn-audit-failed-payments

- Email us for feedback and partnership hello@flycode.com