Healia - Modern health insurance for dual income families 👨👩👦👦 ❤️

We help companies pay for the out of pocket costs of any employee that enrolls in their spouse's health insurance plan.

Tl;dr

Our employee benefit allows companies to cover expenses on a spouse's health insurance. This saves our customers $10k per family while providing an incredible employee perk: 100% coverage of a family’s costs. We handle setup, employee education, and claims reimbursement.

Hey everyone! I’m Priyang and I’m building Healia. We’ve launched 14 customers in 11 states with $206k in ARR and counting.

😱 The problem: Dual-income health insurance is a lose-lose for companies and families

There are 41 million dual-income families in the country and they all have the same problem: whether they choose their plan or their spouse’s, they still have thousands in premium contributions and out-of-pocket costs.

Companies face a similar challenge: either employees enroll in their insurance and incur exorbitant costs ($17k/year/family) or the employee misses out on the largest employee benefit available, hurting the company’s recruitment and retention efforts.

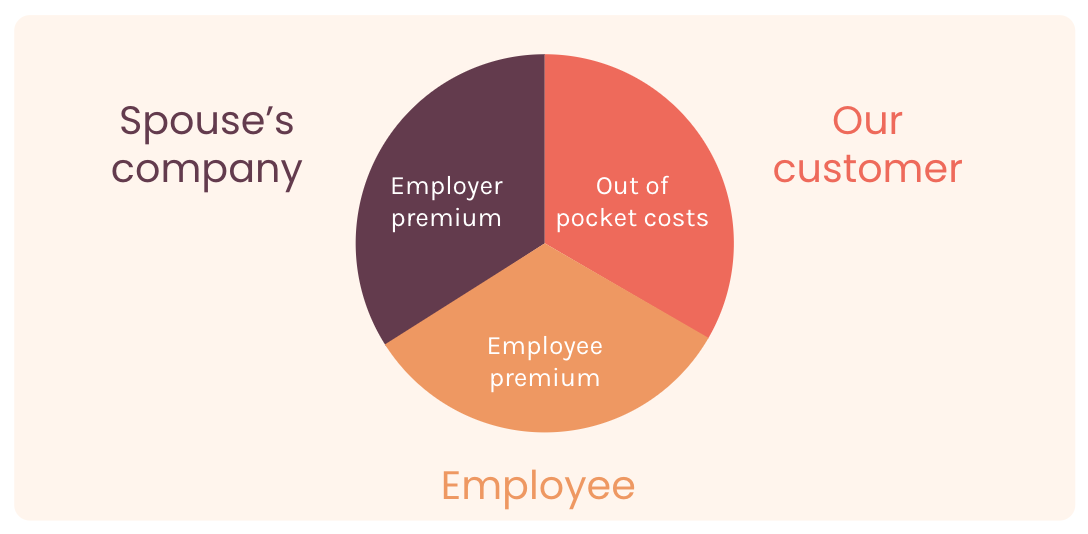

✨ The solution: Both companies “split” coverage

Our product lets employers pay for the out-of-pocket costs (and premiums) of any employee who enrolls in their spouse's plan. There is no need for complicated coordination between employers. Employees just opt out of our customer’s plans and join their spouse’s. We then reimburse any eligible expenses on the spouse’s plan. This saves our customers $10k per enrollee and boosts recruitment and retention with an awesome perk.

💡 How it works (in three easy steps)

- Account Creation: We set up individual accounts for enrollees, funded by employers for eligible expenses ($6k-10k on average).

- Enrollment: Employees access the funds when enrolled in their spouse's plan, using them to cover healthcare costs

- Unused Funds: Any unused funds revert to the employer, ensuring expenses remain capped while employees get the safety of knowing they have thousands of dollars of additional coverage.

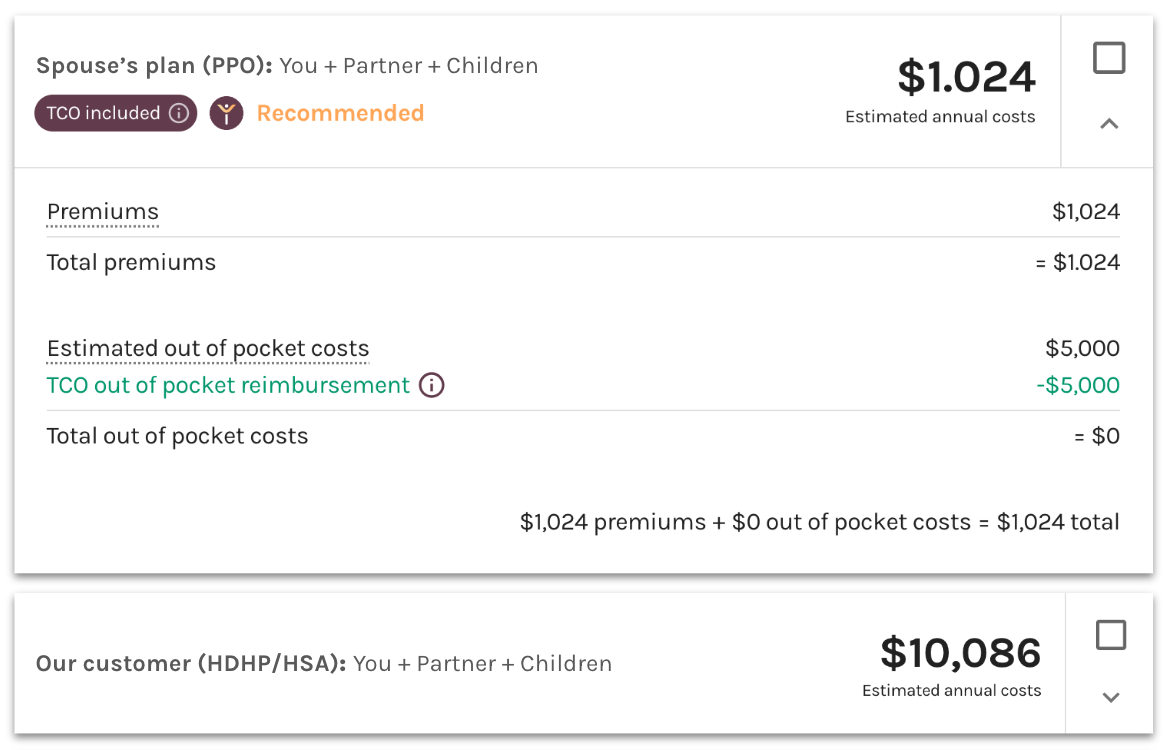

💻 Our technology is so powerful that we even sell it separately

We created a tool for employees that lets them compare costs between their employer's plan and their spouse's. Employees can upload a PDF of their spouse’s benefits guide, and our LLM will process the data, allowing families to see all of their options modeled out (see image below). This feature has been so popular that companies like GoFundMe, Stew Leonard’s, and Sectigo use our technology just to educate employees on what plan to choose.

🚀 14 customers launched across 11 states with $206k in ARR

Initially, we thought only white-collar companies would be interested, but half of our customers have been in traditional industries like manufacturing, food and beverage, and retail. We're helping businesses across all geographies and industries lower costs and make healthcare more affordable.

👋 Ask: Connect us with:

- Health insurance brokers that need innovative solutions for clients.

- HR leaders and CFO’s that want to lower costs while improving employee retention

- Or, just give us feedback! founders@healiahealth.com