Simplifying insurance for large real estate investors

tl;dr: Homeflow is the first digital platform that gives large real estate investors a single place to purchase and manage insurance for their portfolio. Rather than having policies spread out between multiple agents/brokers, real estate managers can use Homeflow to view their policies, change coverages, and get quotes for upcoming acquisitions.

Hi everyone, we’re Perry and Christian, co-founders of Homeflow.

🤔 Why are we the right ones to work on this?

Perry was the 5th business hire at Hippo Insurance and was there through the IPO, building and leading the sales operations team.

Christian was the youngest staff engineer at Mosaic, a unicorn proptech company, where he led engineering for a new business line that grew to $10M ARR in 6 months.

❌ What’s the problem?

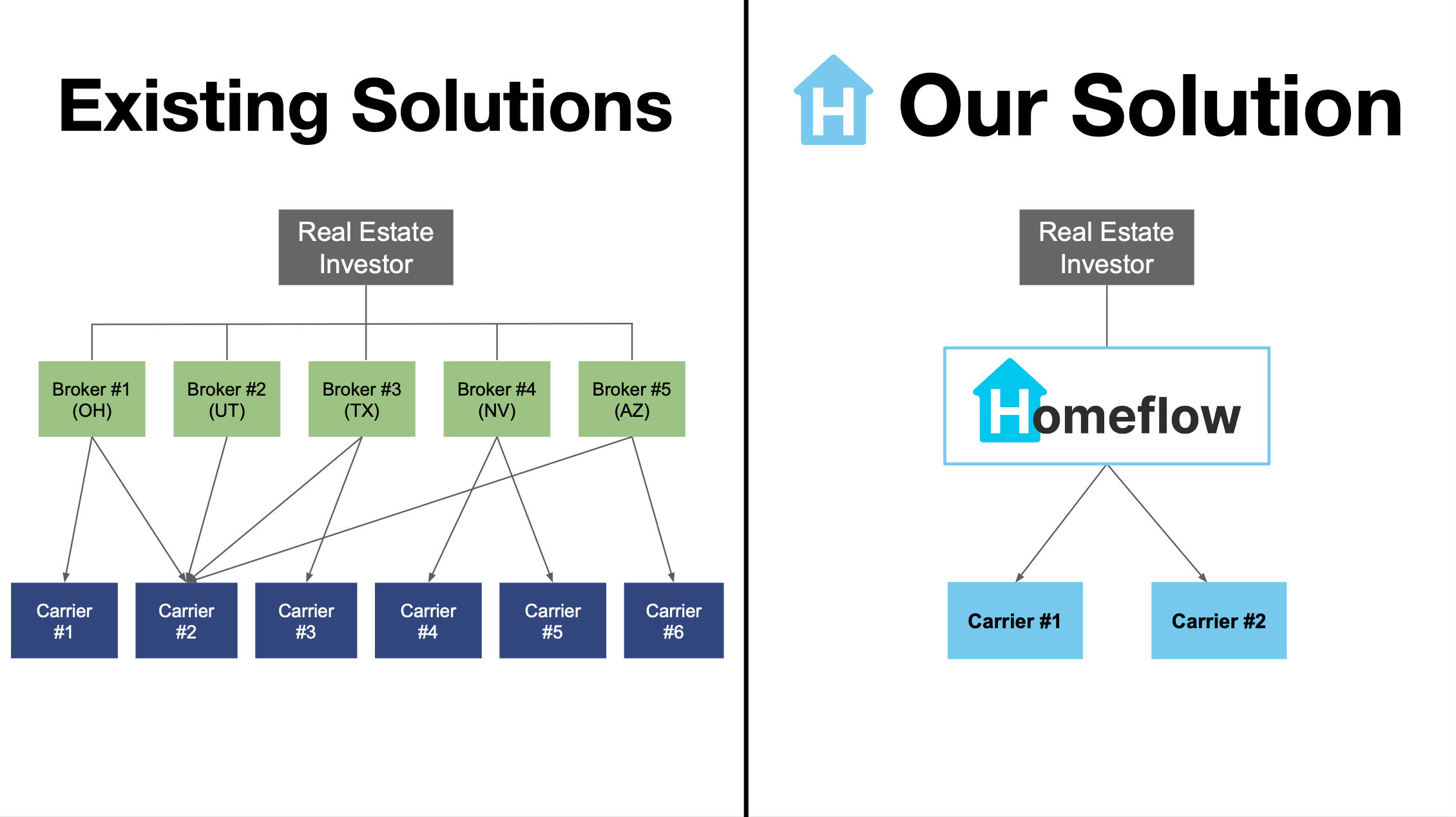

Larger real estate investors deal with inefficiencies when managing their insurance. For example, one of our partners has 200 units, and their insurance was placed with 5 different brokers across 6 insurance companies (carriers). This occurs because 1) insurance brokers are often state-specific since insurance is regulated and licensed on a state-by-state basis and 2) the insurance carriers that sell 1-4 family unit properties are frequently different from the ones that sell 5+ family unit properties.

Also, real estate investors with a traditional broker still need to call or email if they want to get an updated policy document or file a claim. As a result, the insurance experience has been highly service-dependent, only as good as the broker.

👨🏼💻 What have we built?

Homeflow is the first digital platform that gives real estate investors a single place to purchase and manage insurance for their portfolio. Homeflow’s nationwide footprint and 50+ carriers provide real estate investors with a single platform for all of their insurance needs. Real estate investors can also use Homeflow’s self-service platform to view all policy documents, manage their claims, or request changes to their policy.

👋 Asks:

Are you (or someone you know) a real estate investor looking to simplify and save on your insurance? Feel free to reach out to founders@homeflow.me or book a meeting with us here. We would love to connect and hear if we can help you more effectively manage your insurance coverage.