First LatAm W3 WealthTech for AutoInvesting in securities & crypto

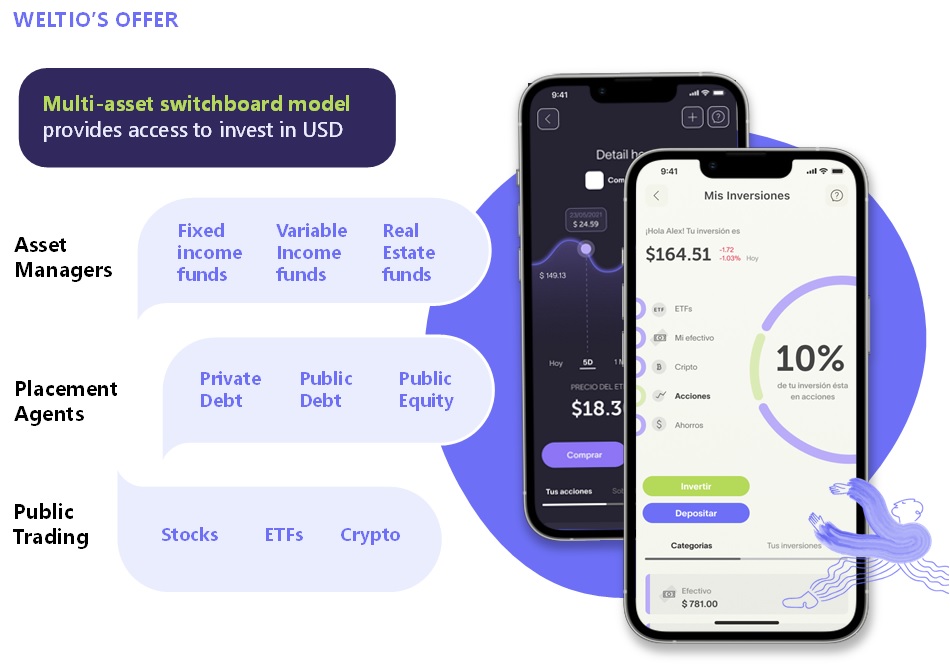

Hey everyone! We are excited to launch Weltio - a low cost platform designed for Latam users to open a brokerage account in US dollars for investment in US equities and 20+ cryptocurrencies. Weltio is built on an API first model that allows us to focus on the user experience by building features for the middleware and front end.

The Problem

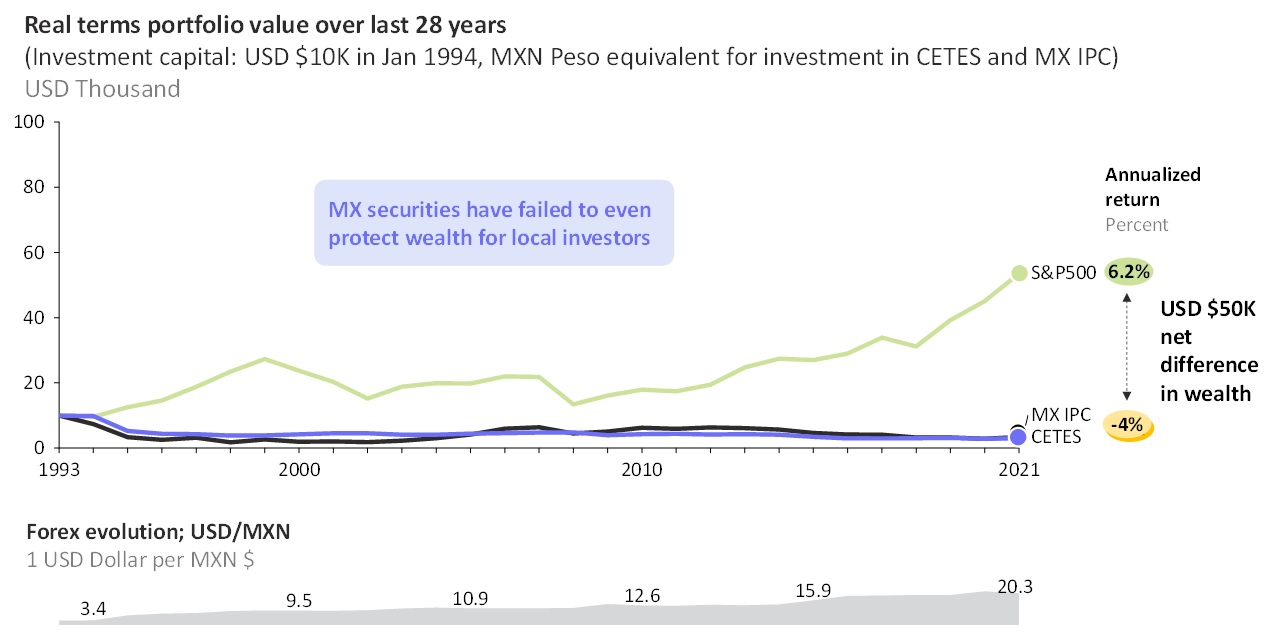

There is a historical challenge to create and transfer wealth through generations in Latin America. There is a lack of access to world-class assets for the middle and middle-upper classes, costs are high, education is low, and customer experience is lagging behind advanced economies. In the past 30 years, investing in the US markets has yielded a 5x benefit (adjusted for inflation), while in Mexico, as an example, yields negative returns.

The chart below summarizes how big the overall disparity of investment outcomes between the investing in local assets vs. global assets:

The Solution

Weltio allows users to open a brokerage account in the US in less than 5 minutes with a smooth onboarding process. Once the account is open, users can fund their accounts with a domestic wire (in our initial geography Mexico, wires are made in MXN). The user then receives a deposit in USD in their account in less than 30 minutes! From their account they can invest in stocks and ETFs and buy/sell cryptocurrencies (20+ available) - we have zero cost for trading and have a very competitive commissions structure for crypto. Additionally, we believe it is our duty to enable our users to make the best investment decisions by providing essential information and education modules for them to make the best decisions.

Background on the Idea and Founders

Weltio started in fall 2021, but the desire to give access to high-quality financial services to people in Latin America started years before that. David has spent most of his professional career as a consultant for McKinsey and Oliver Wyman, advising financial institutions in more than 15 countries in 4 continents, where he has seen, first-hand, the vast difference in financial products and services offered. George spent several years as a consultant for McKinsey, also advising financial institutions. After deciding to leave for tech, he joined Wayfair and Klarna in Berlin, where he developed expertise in product. David and George met more than 10 years ago at McKinsey, where they worked together on several projects and have remained good friends since then.

Asks for the Community

Download the platform and tell us your thoughts! Although the platform is for now only covering Mexico, feedback on the platform helps us build a world-class product, ping us directly and we can provide a test-user account.

If you or someone you know offers API based investing, or yield as a service please reach out! We’d love to connect and explore a potential partnership going forward.

Reach Out

Feel free to reach out to us on social media: Instagram (@weltioapp), Facebook (/weltioapp), twitter (@weltioapp), LinkedIn (Weltio) or at: founders@weltio.com