Ryse: The secondary market for real estate leases

Ryse enables the trading of $1.5T in leases between banks/asset managers and real estate operators

Hello everyone! We’re Harsh, Sean, Tom and Seva. We’re building Ryse: the secondary market for real estate leases.

See it here: Ryse | Innovative Growth Capital For Modern Real Estate Operators (rysemarket.com)

TL;DR

Ryse is the only marketplace where investors who want to buy leases can trade with real estate operators who want to sell leases.

The Problem

Financial institutions like banks, asset managers and insurance companies want to invest directly into the $1.5T in real estate leases originated in the US each year, but they can’t. Why?

- There's no marketplace for buyers and sellers to meet

- There's no access to or standardization of the data required to underwrite opportunities

- There's no existing infrastructure to support trading, reporting, or payment processing

The Solution

Ryse is the first marketplace where lease buyers and sellers can transact seamlessly. We're building a marketplace where:

- Buyers have access to underwriting data sourced directly from custom API integrations with Sellers

- We standardize that data into a format that makes it easy to understand and compare to other investments (loans, bonds, t-bills, etc.)

- We automate trade execution, reporting, and payment processing

- We enable real estate experience providers to innovate and scale without balance sheet risk.

See Who Our Customers Are:

User Experience

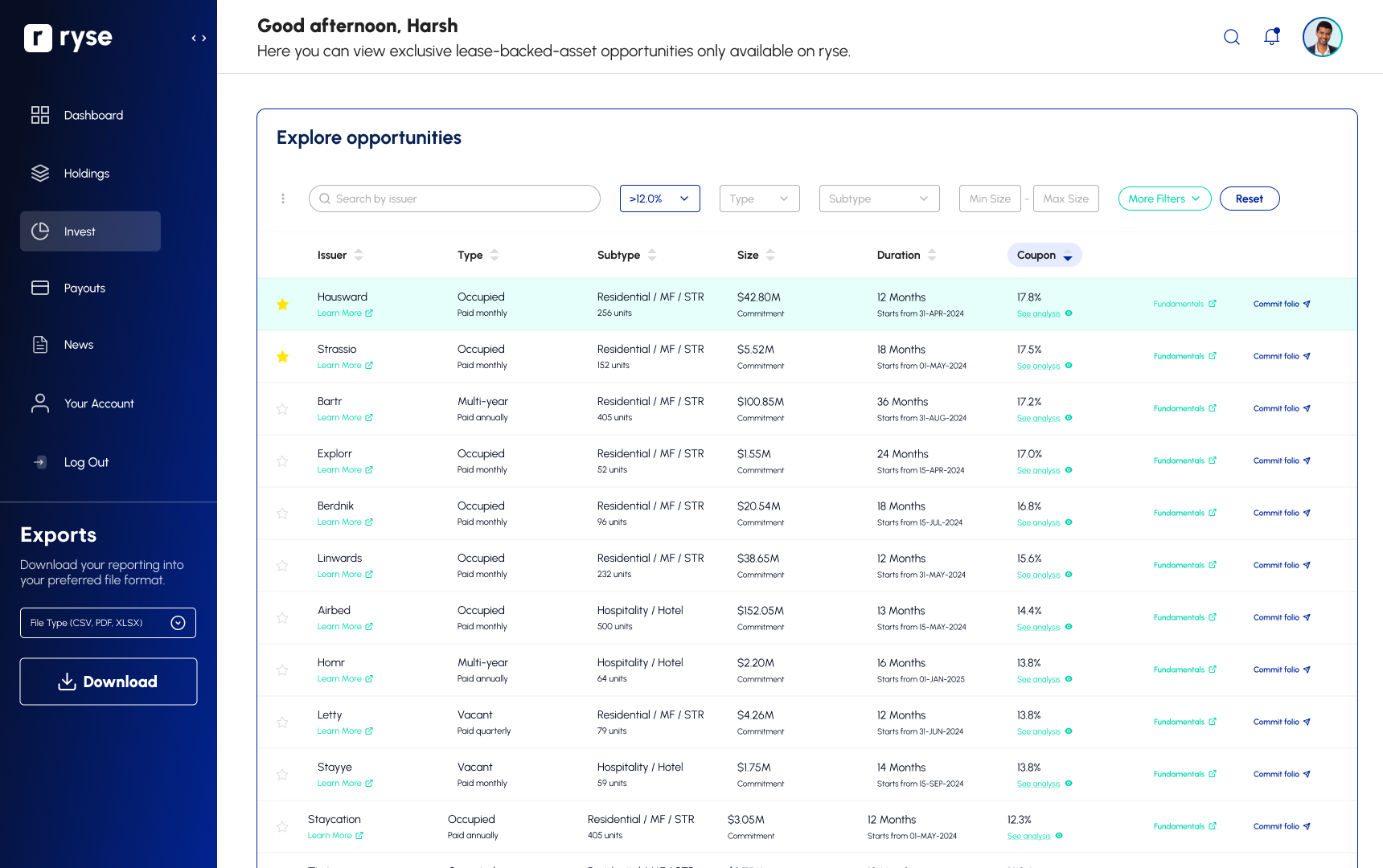

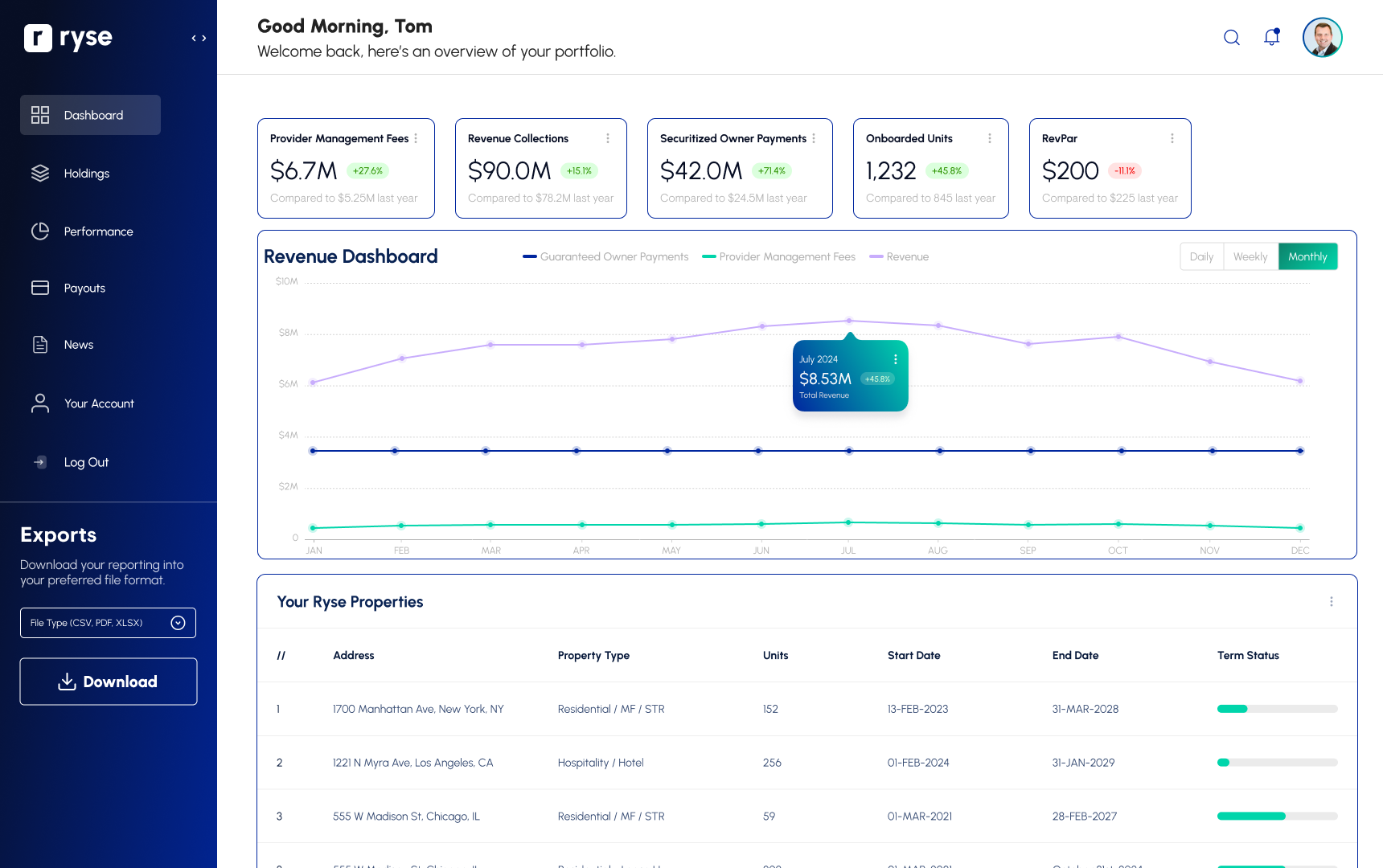

See how our customers interact with Ryse:

-

Buyers:

-

Sellers:

Traction

Since launching 10 weeks ago, we've signed a $100M term sheet with our first buyer, a $3B+ AUM asset manager. We are also engaged in late-stage negotiations on our first $50M seller term sheet, which is expected to close in Q2 2024.

An Experienced Team

Our founding team worked together at REZI (YC W17), a prop-tech company whose software aimed to make renting an apartment as simple as ordering on Doordash. When building REZI, we learned that financial institutions had an enormous appetite to buy leases as an asset class.

Our Ask

If you’re a real estate operator or financial institution interested in using Ryse, please email us at hello@rysemarket.com