AI for “what if” scenarios in critical industries

Fynt is an autonomous planning & action system for operational data in critical industries, starting with fast moving consumer goods. We unify organisational data in a digital twin where our AI agents can think, predict, and act to answer "what if" scenarios focused on revenue optimisation.

Active Founders

Company Launches

TL;DR:

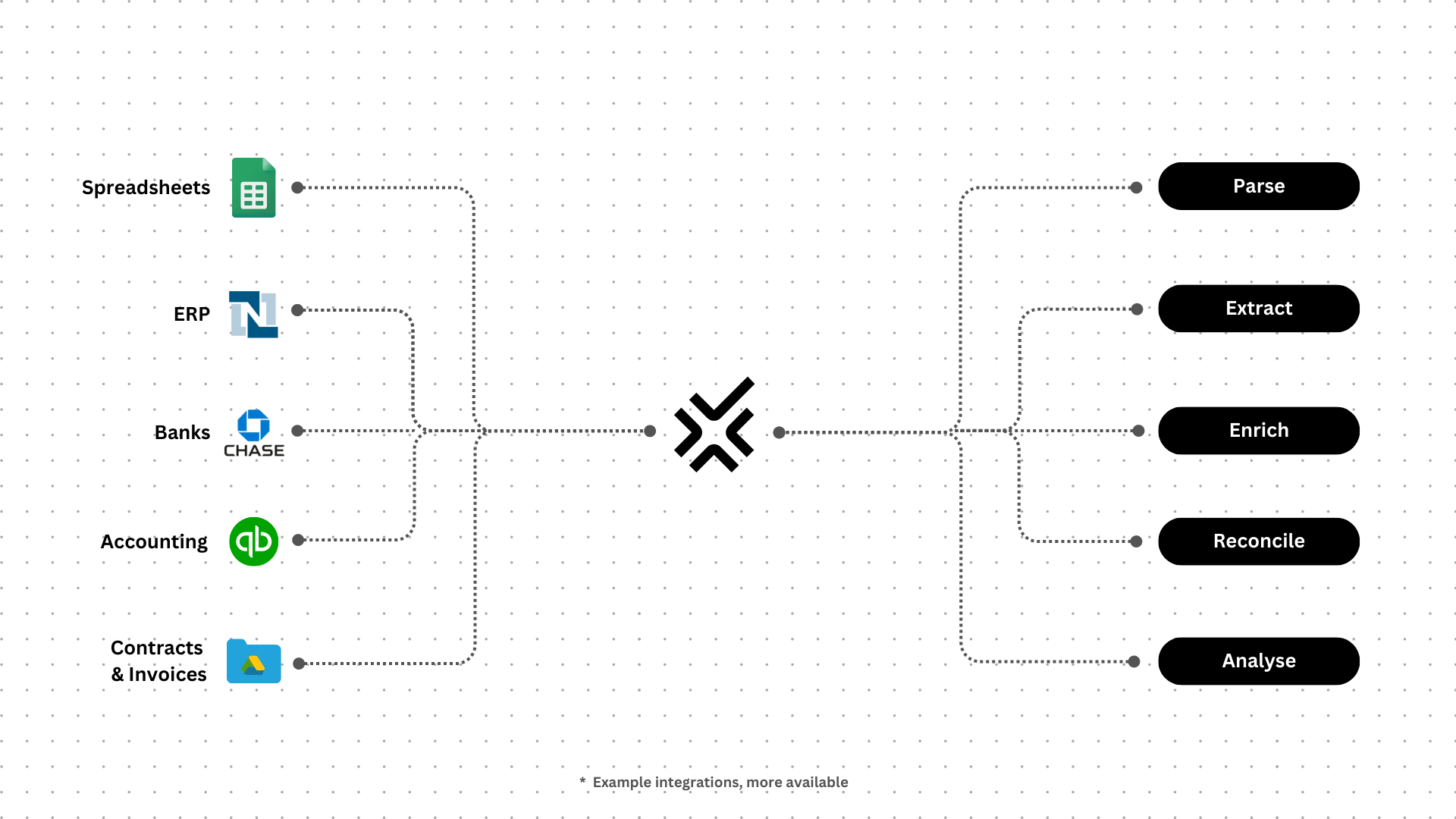

Fynt lets in-house finance teams connect all business bank accounts, accounting software, and ERPs to accelerate decision-making, extract & enrich data, and automate reconciliation. Our technology summarises financial documents and spreadsheets, automates invoice and bank reconciliation, and lets you ask questions about your data like "How much did we spend on materials last quarter?"

Hi fellow readers, we are Nick and Alex - the Co-Founders of Fynt. We are Bulgarians who moved to Silicon Valley to change the way CFOs and Financial Controllers run finance teams across the globe.

The Problem:

Once a company scales, Finance teams are riddled with manual tasks that block the business decision-makers. From bank & document data extraction and categorization to reconciliation, the finance teams are often left manually going through all the banks, invoices, and sales contracts, and shifting data from one source to another, and inevitably dumping everything in a spreadsheet. Once month/year end comes and it’s time to report, nothing helps but taking an aspirin for the headache 💊

The Solution:

Fynt lets in-house finance teams connect all business bank accounts, accounting software, and ERPs to accelerate decision-making, extract & enrich data, and automate reconciliation.

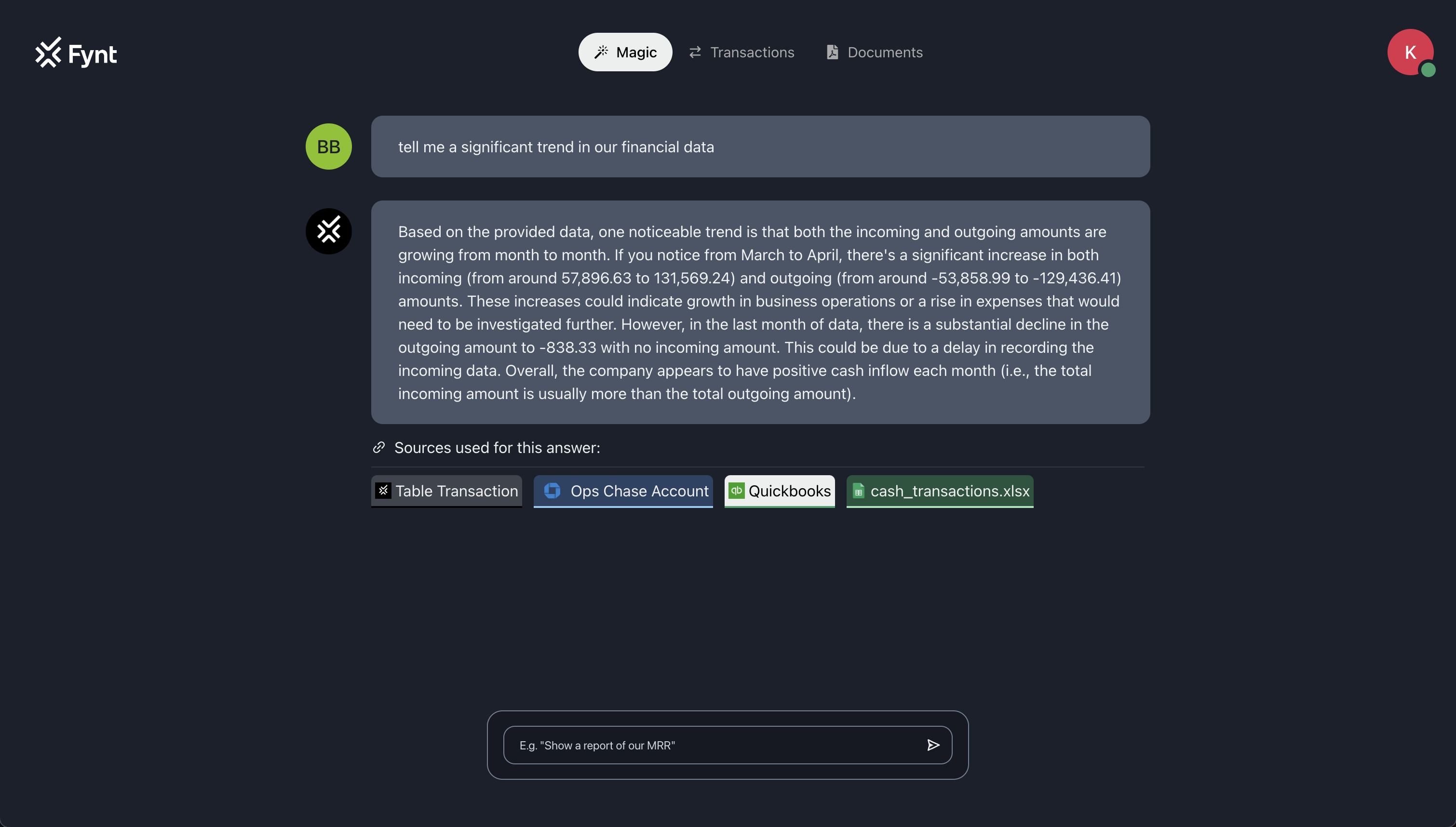

Our technology summarises financial documents and spreadsheets, automates invoice and bank reconciliation, and lets you ask questions about your data like "how much did we spend on materials last quarter?"

For example: We are working with an electric car manufacturer that uses Fynt to extract information from different file type/structure invoices and auto-reconcile to the bank, purchase order, and sales contracts with custom categories of spending.

👉 How it works:

💭 Let’s find something interesting:

The Story:

I (Nick) grew up around my entrepreneurial parents who are running a real estate business together, where I’d constantly see my mother reconciling and crunching numbers on Excel spreadsheets until early AM just to keep the business running and provide my father with insights into what exactly is going on with their finances. When me and Alex started our first business together we noticed all the same troubles and we wanted a better solution that could let us be founders, not CFOs. After talking with many business owners we saw that the problem never gets solved, you just scale your finance/accounting department.

The Ask:

If you know any founders, financial controllers, CFOs of 200+ employee companies, we’d love a warm introduction! My email is nick@fynt.ai

You can sign up for a demo at https://fynt.ai/ now 🚀